Modelling with Linear Regression

Slides and Tutorials

| Multiple Regression - Forward Selection | Multiple Regression - Backward Selection | Permutation Test for Regression |

Plot Fonts and Theme

Show the Code

library(systemfonts)

library(showtext)

## Clean the slate

systemfonts::clear_local_fonts()

systemfonts::clear_registry()

##

showtext_opts(dpi = 96) # set DPI for showtext

sysfonts::font_add(

family = "Alegreya",

regular = "../../../../../../fonts/Alegreya-Regular.ttf",

bold = "../../../../../../fonts/Alegreya-Bold.ttf",

italic = "../../../../../../fonts/Alegreya-Italic.ttf",

bolditalic = "../../../../../../fonts/Alegreya-BoldItalic.ttf"

)Error in check_font_path(bold, "bold"): font file not found for 'bold' typeShow the Code

sysfonts::font_add(

family = "Roboto Condensed",

regular = "../../../../../../fonts/RobotoCondensed-Regular.ttf",

bold = "../../../../../../fonts/RobotoCondensed-Bold.ttf",

italic = "../../../../../../fonts/RobotoCondensed-Italic.ttf",

bolditalic = "../../../../../../fonts/RobotoCondensed-BoldItalic.ttf"

)

showtext_auto(enable = TRUE) # enable showtext

##

theme_custom <- function() {

font <- "Alegreya" # assign font family up front

theme_classic(base_size = 14, base_family = font) %+replace% # replace elements we want to change

theme(

text = element_text(family = font), # set base font family

# text elements

plot.title = element_text( # title

family = font, # set font family

size = 24, # set font size

face = "bold", # bold typeface

hjust = 0, # left align

margin = margin(t = 5, r = 0, b = 5, l = 0)

), # margin

plot.title.position = "plot",

plot.subtitle = element_text( # subtitle

family = font, # font family

size = 14, # font size

hjust = 0, # left align

margin = margin(t = 5, r = 0, b = 10, l = 0)

), # margin

plot.caption = element_text( # caption

family = font, # font family

size = 9, # font size

hjust = 1

), # right align

plot.caption.position = "plot", # right align

axis.title = element_text( # axis titles

family = "Roboto Condensed", # font family

size = 12

), # font size

axis.text = element_text( # axis text

family = "Roboto Condensed", # font family

size = 9

), # font size

axis.text.x = element_text( # margin for axis text

margin = margin(5, b = 10)

)

# since the legend often requires manual tweaking

# based on plot content, don't define it here

)

}Show the Code

```{r}

#| cache: false

#| code-fold: true

## Set the theme

theme_set(new = theme_custom())

## Use available fonts in ggplot text geoms too!

update_geom_defaults(geom = "text", new = list(

family = "Roboto Condensed",

face = "plain",

size = 3.5,

color = "#2b2b2b"

))

```

One of the most common problems in Prediction Analytics is that of predicting a Quantitative response variable, based on one or more Quantitative predictor variables or features. This is called Linear Regression. We will use the intuitions built up during our study of ANOVA to develop our ideas about Linear Regression.

Suppose we have data on salaries in a Company, with years of study and previous experience. Would we be able to predict the prospective salary of a new candidate, based on their years of study and experience? Or based on the mileage done, could we predict the resale price of a used car? These are typical problems in Linear Regression.

In this tutorial, we will use the Boston housing dataset. Our research question is:

How do we predict the price of a house in Boston, based on other parameters Quantitative parameters such as area, location, rooms, and crime-rate in the neighbourhood?

The premise here is that many common statistical tests are special cases of the linear model.

A linear model estimates the relationship between one continuous or ordinal variable (dependent variable or “response”) and one or more other variables (explanatory variable or “predictors”). It is assumed that the relationship is linear:1

or

but not:

or

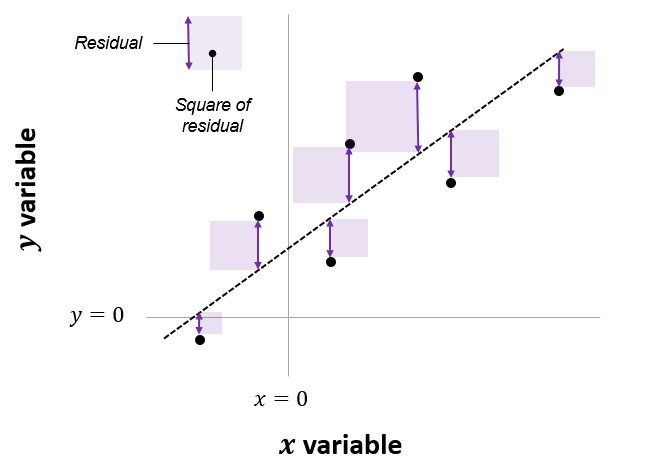

In Equation 1,

The net area of all the shaded squares is minimized in the calculation of t-tests to two-way ANOVA, are special cases of this system. Also see Jeffrey Walker “A linear-model-can-be-fit-to-data-with-continuous-discrete-or-categorical-x-variables”.

Using linear models is based on the idea of Testing of Hypotheses. The Hypothesis Testing method typically defines a NULL Hypothesis where the statements read as “there is no relationship” between the variables at hand, explanatory and responses. The Alternative Hypothesis typically states that there is a relationship between the variables.

Accordingly, in fitting a linear model, we follow the process as follows:

With

- Make the following hypotheses:

- We “assume” that

- We calculate

- We then find probability p(

- However, if p<= 0.05 can we reject the NULL hypothesis, and say that there could be a significant linear relationship, because the probability p that

When does a Linear Model work? We can write the assumptions in Linear Regression Models as an acronym, LINE:

1. L:

3. N:

4. E:

Hence a very concise way of expressing the Linear Model is:

The target variable

OK, on with the computation!

Let us now read in the data and check for these assumptions as part of our Workflow.

categorical variables:

name class levels n missing distribution

1 town factor 92 506 0 Cambridge (5.9%) ...

2 chas factor 2 506 0 0 (93.1%), 1 (6.9%)

quantitative variables:

name class min Q1 median Q3 max

1 tract integer 1.00000 1303.250000 3393.50000 3739.750000 5082.0000

2 lon numeric -71.28950 -71.093225 -71.05290 -71.019625 -70.8100

3 lat numeric 42.03000 42.180775 42.21810 42.252250 42.3810

4 medv numeric 5.00000 17.025000 21.20000 25.000000 50.0000

5 cmedv numeric 5.00000 17.025000 21.20000 25.000000 50.0000

6 crim numeric 0.00632 0.082045 0.25651 3.677083 88.9762

7 zn numeric 0.00000 0.000000 0.00000 12.500000 100.0000

8 indus numeric 0.46000 5.190000 9.69000 18.100000 27.7400

9 nox numeric 0.38500 0.449000 0.53800 0.624000 0.8710

10 rm numeric 3.56100 5.885500 6.20850 6.623500 8.7800

11 age numeric 2.90000 45.025000 77.50000 94.075000 100.0000

12 dis numeric 1.12960 2.100175 3.20745 5.188425 12.1265

13 rad integer 1.00000 4.000000 5.00000 24.000000 24.0000

14 tax integer 187.00000 279.000000 330.00000 666.000000 711.0000

15 ptratio numeric 12.60000 17.400000 19.05000 20.200000 22.0000

16 b numeric 0.32000 375.377500 391.44000 396.225000 396.9000

17 lstat numeric 1.73000 6.950000 11.36000 16.955000 37.9700

mean sd n missing

1 2700.3557312 1.380037e+03 506 0

2 -71.0563887 7.540535e-02 506 0

3 42.2164403 6.177718e-02 506 0

4 22.5328063 9.197104e+00 506 0

5 22.5288538 9.182176e+00 506 0

6 3.6135236 8.601545e+00 506 0

7 11.3636364 2.332245e+01 506 0

8 11.1367787 6.860353e+00 506 0

9 0.5546951 1.158777e-01 506 0

10 6.2846344 7.026171e-01 506 0

11 68.5749012 2.814886e+01 506 0

12 3.7950427 2.105710e+00 506 0

13 9.5494071 8.707259e+00 506 0

14 408.2371542 1.685371e+02 506 0

15 18.4555336 2.164946e+00 506 0

16 356.6740316 9.129486e+01 506 0

17 12.6530632 7.141062e+00 506 0The original data are 506 observations on 14 variables, medv being the target variable:

| crim | per capita crime rate by town |

| zn | proportion of residential land zoned for lots over 25,000 sq.ft |

| indus | proportion of non-retail business acres per town |

| chas | Charles River dummy variable (= 1 if tract bounds river; 0 otherwise) |

| nox | nitric oxides concentration (parts per 10 million) |

| rm | average number of rooms per dwelling |

| age | proportion of owner-occupied units built prior to 1940 |

| dis | weighted distances to five Boston employment centres |

| rad | index of accessibility to radial highways |

| tax | full-value property-tax rate per USD 10,000 |

| ptratio | pupil-teacher ratio by town |

| b |

|

| lstat | percentage of lower status of the population |

| medv | median value of owner-occupied homes in USD 1000’s |

The corrected data set has the following additional columns:

| cmedv | corrected median value of owner-occupied homes in USD 1000’s |

| town | name of town |

| tract | census tract |

| lon | longitude of census tract |

| lat | latitude of census tract |

Our response variable is cmedv, the corrected median value of owner-occupied homes in USD 1000’s. Their are many Quantitative feature variables that we can use to predict cmedv. And there are two Qualitative features, chas and tax.

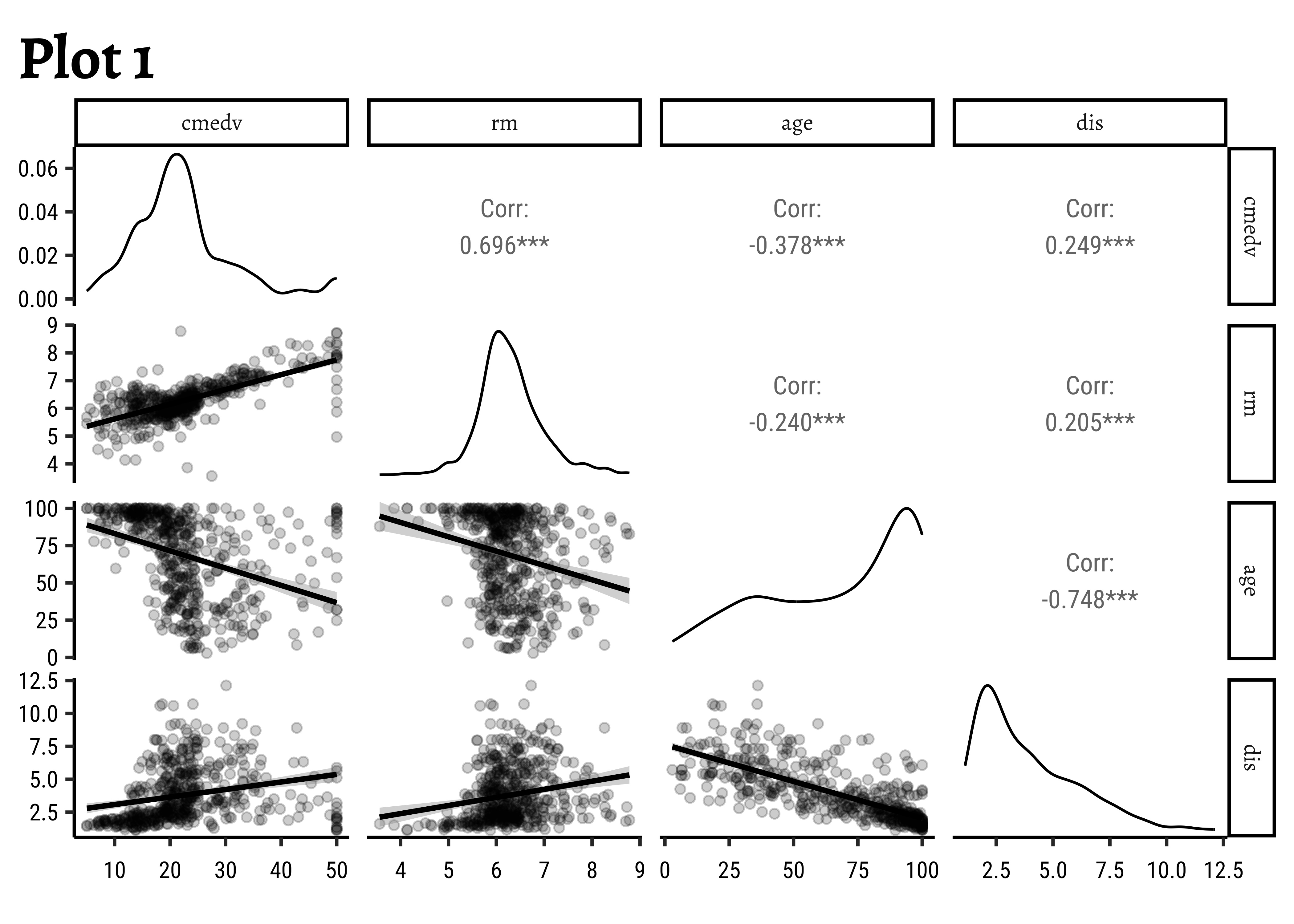

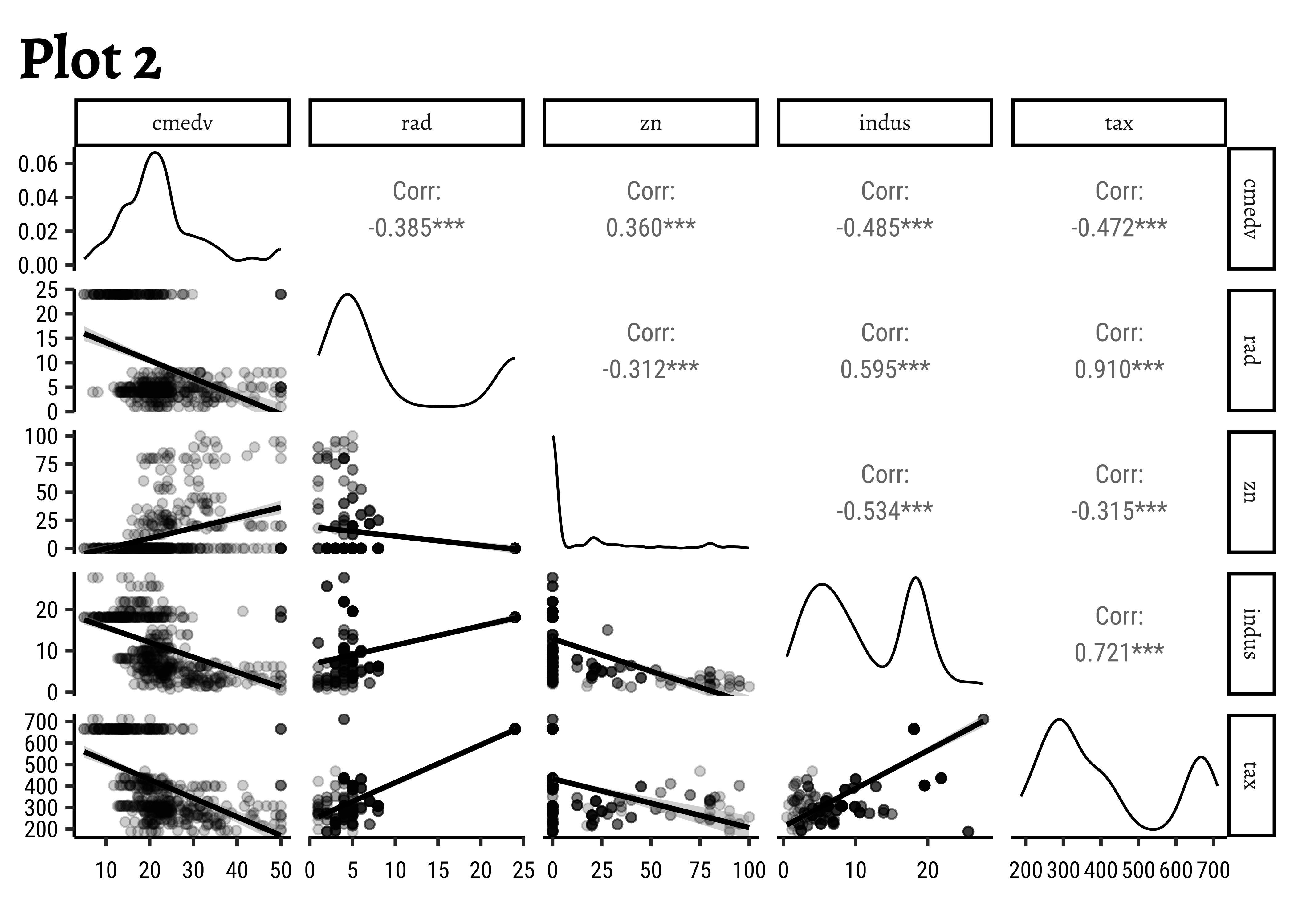

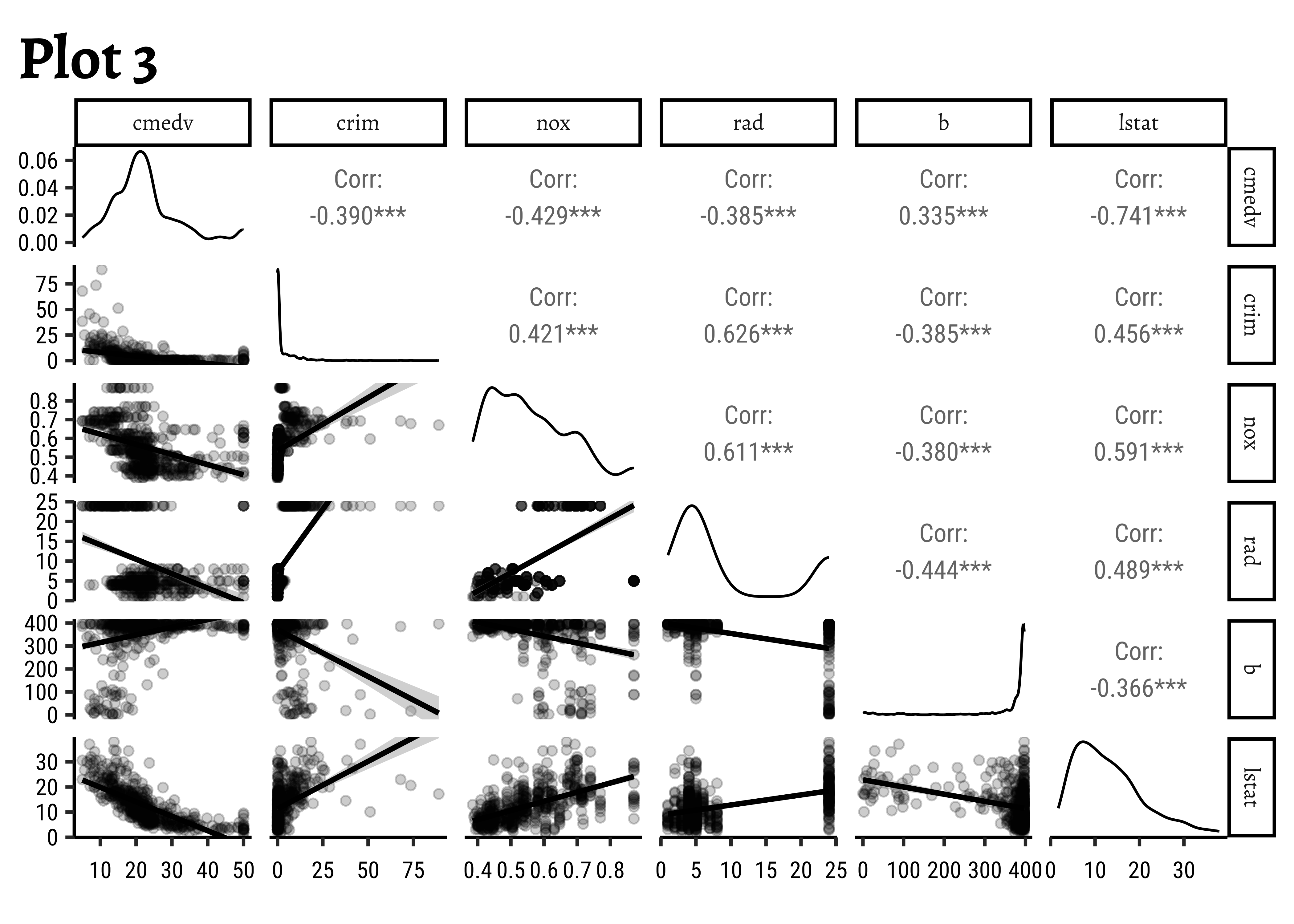

In order to fit the linear model, we need to choose predictor variables that have strong correlations with the target variable. We will first do this with GGally, and then with the tidyverse itself. Both give us a very unique view into the correlations that exist within this dataset.

Let us select a few sets of Quantitative and Qualitative features, along with the target variable cmedv and do a pairs-plots with them:

# Set graph theme

theme_set(new = theme_custom())

#

housing %>%

# Target variable cmedv

# Predictors Rooms / Age / Distance to City Centres / Radial Highway Access

select(cmedv, rm, age, dis) %>%

GGally::ggpairs(

title = "Plot 1",

progress = FALSE,

lower = list(continuous = wrap("smooth",

alpha = 0.2

))

)##

housing %>%

# Target variable cmedv

# Predictors: Access to Radial Highways, / Resid. Land Proportion / proportion of non-retail business acres / full-value property-tax rate per USD 10,000

select(cmedv, rad, zn, indus, tax) %>%

GGally::ggpairs(

title = "Plot 2",

progress = FALSE,

lower = list(continuous = wrap("smooth",

alpha = 0.2

))

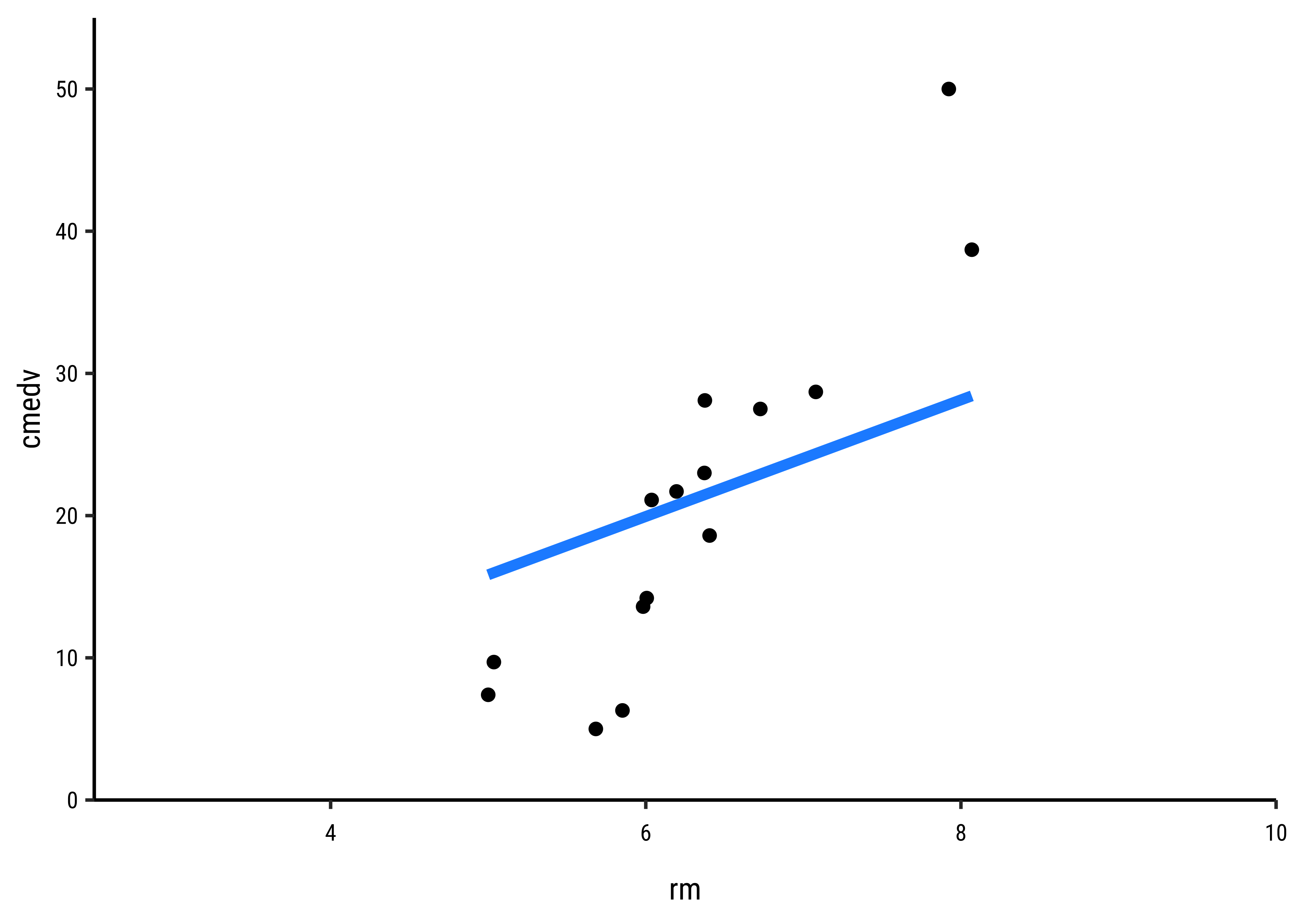

)See the top row of the pairs plots. Clearly, rm (avg. number of rooms) is a big determining feature for median price cmedv. This we infer based on the large correlation of rm withcmedv, age (proportion of owner-occupied units built prior to 1940) may also be a significant influence on cmedv, with a correlation of

None of the Quant variables rad, zn, indus, tax have a overly strong correlation with cmedv. .

The variable lstat (proportion of lower classes in the neighbourhood) as expected, has a strong (negative) correlation with cmedv; rad(index of accessibility to radial highways), nox(nitrous oxide) and crim(crime rate) also have fairly large correlations with cmedv, as seen from the pairs plots.

Recall that cor.test reports a correlation score and the p-value for the same. There is also a confidence interval reported for the correlation score, an interval within which we are 95% sure that the true correlation value is to be found.

Note that GGally too reports the significance of the correlation scores using stars, *** or **. This indicates the p-value in the scores obtained by GGally; Presumably, there is an internal cor.test that is run for each pair of variables and the p-value and confidence levels are also computed internally.

Let us plot (again) scatter plots of Quant Variables that have strong correlation with cmedv:

# Set graph theme

theme_set(new = theme_custom())

#

gf_point(

data = housing,

cmedv ~ age,

title = "Price vs Proportion of houses older than 1940",

ylab = "Median Price",

xlab = "Proportion of older-than-1940 buildings")

##

gf_point(

data = housing,

cmedv ~ lstat,

title = "Price vs Proportion of lower classes..."

subtitle = "...In the neighbourhood",

ylab = "Median Price",

xlab = "proportion of lower classes in the neighbourhood")

##

gf_point(

data = housing,

cmedv ~ rm,

title = "Price vs Average no. of Rooms",

ylab = "(cmedv) Median Price",

xlab = "(rm) Avg. No. of Rooms")Error in parse(text = input): <text>:16:3: unexpected symbol

15: title = "Price vs Proportion of lower classes..."

16: subtitle

^So, rm does have a positive effect on cmedv, and age may have a (mild?) negative effect on cmedv; lstat seems to have a pronounced negative effet on cmedv. We have now managed to get a decent idea which Quant predictor variables might be useful in modelling cmedv: rm, lstat for starters, then perhapsage.

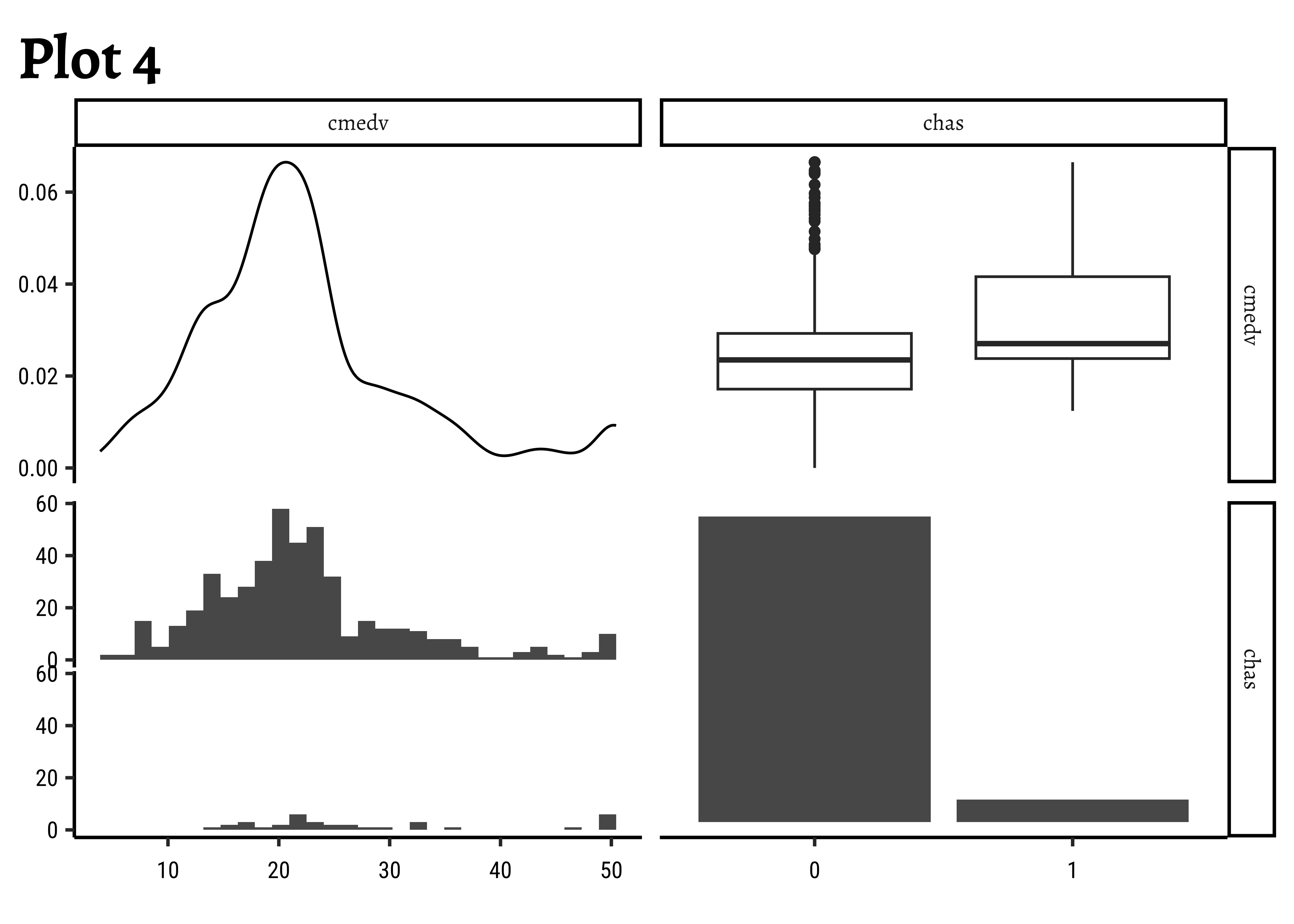

Let us also check the Qualitative predictor variables: Access to the Charles river (chas) does seem to affect the prices somewhat.

Look at the bar plot above. While not too many properties can be near the Charles River (for obvious reasons) the box plots do seem to show some dependency of cmedv on chas.

Qualitative predictors for a Quantitative target can be included in the model using what is called dummy variables, where each level of the Qualitative variable is given a one-hot kind of encoding. See for example https://www.statology.org/dummy-variables-regression/

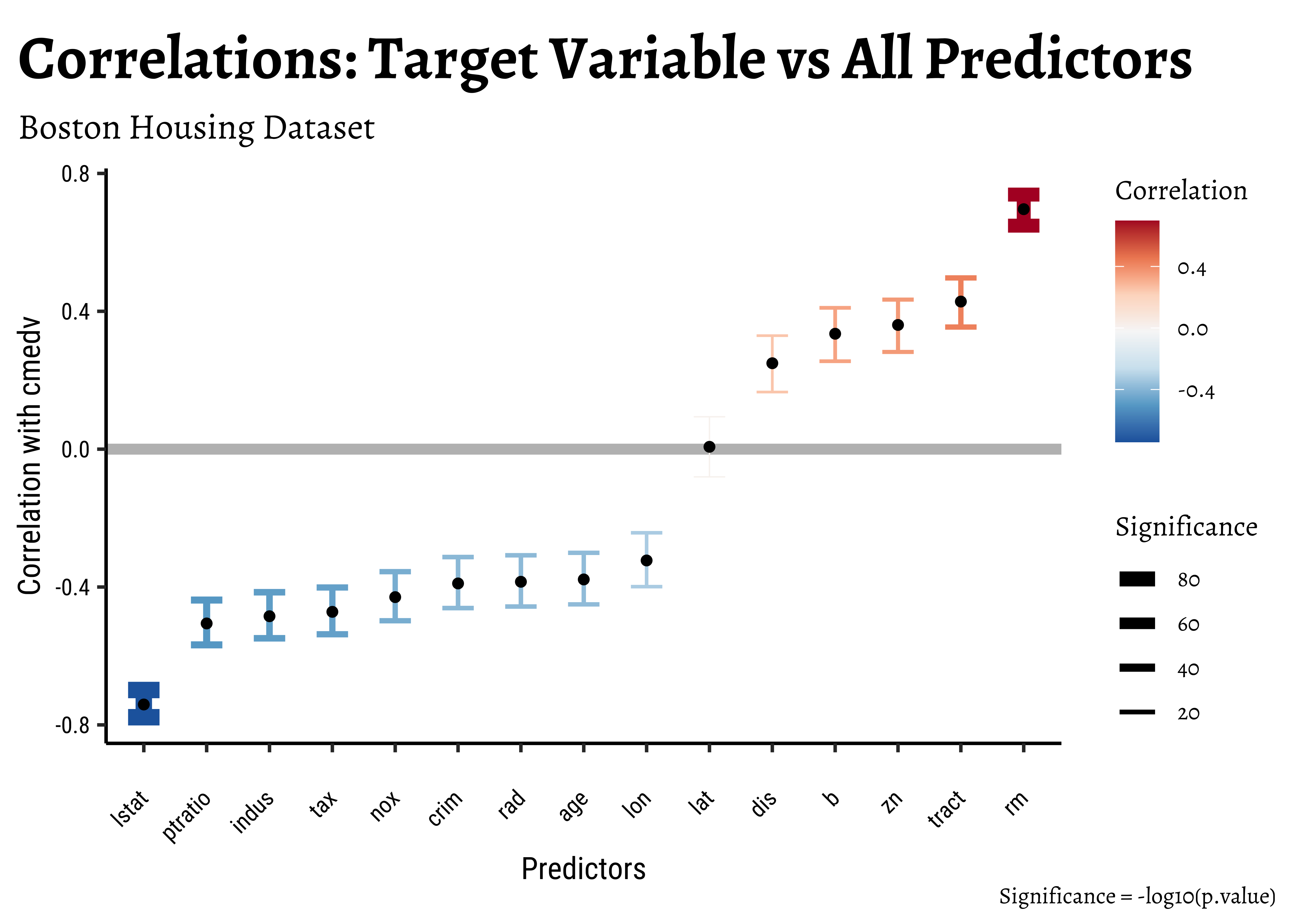

This is somewhat advanced material: We will use the purrr package to develop all correlations with respect to our target variable in one shot and also plot these correlation test scores in an error-bar plot. See Tidy Modelling with R. This has the advantage of being able to depict all correlations in one plot. (We will use this approach again here when we trim our linear models down from the maximal one to a workable one of lesser complexity.). Let us do this.

We develop a list object containing all correlation test results with respect to cmedv, tidy these up using broom::tidy, and then plot these:

# Set graph theme

theme_set(new = theme_custom())

#

all_corrs <- housing %>%

select(where(is.numeric)) %>%

# leave off target variable cmedv and IDs

# get all the remaining ones

select(-cmedv, -medv) %>%

purrr::map(

.x = ., # All numeric variables selected in the previous step

.f = \(.x) cor.test(.x, housing$cmedv)

) %>% # Apply the cor.test with `cmedv`

# Tidy up the cor.test outputs into neat columns

# Need ".id" column to keep track of predictor variable name

map_dfr(broom::tidy, .id = "predictor")

all_corrspredictor <chr> | estimate <dbl> | statistic <dbl> | p.value <dbl> | parameter <int> | |

|---|---|---|---|---|---|

| tract | 0.428251535 | 10.6392091 | 5.514616e-24 | 504 | |

| lon | -0.322946685 | -7.6606125 | 9.548359e-14 | 504 | |

| lat | 0.006825792 | 0.1532422 | 8.782686e-01 | 504 | |

| crim | -0.389582441 | -9.4963995 | 8.711542e-20 | 504 | |

| zn | 0.360386177 | 8.6734797 | 5.785518e-17 | 504 | |

| indus | -0.484754379 | -12.4423538 | 3.522132e-31 | 504 | |

| nox | -0.429300219 | -10.6711394 | 4.167568e-24 | 504 | |

| rm | 0.696303794 | 21.7792304 | 1.307493e-74 | 504 | |

| age | -0.377998896 | -9.1661252 | 1.241939e-18 | 504 | |

| dis | 0.249314834 | 5.7796099 | 1.313250e-08 | 504 |

all_corrs %>%

gf_hline(

yintercept = 0,

color = "grey",

linewidth = 2,

title = "Correlations: Target Variable vs All Predictors",

subtitle = "Boston Housing Dataset"

) %>%

gf_errorbar(

conf.high + conf.low ~ reorder(predictor, estimate),

colour = ~estimate,

width = 0.5,

linewidth = ~ -log10(p.value),

caption = "Significance = -log10(p.value)"

) %>%

# Plot points(smallest geom) last!

gf_point(estimate ~ reorder(predictor, estimate)) %>%

gf_labs(x = "Predictors", y = "Correlation with cmedv") %>%

# gf_theme(theme_minimal()) %>%

# tilt the x-axis labels for readability

gf_theme(theme(axis.text.x = element_text(angle = 45, hjust = 1))) %>%

# Colour and linewidth scales + legends

gf_refine(

scale_colour_distiller("Correlation", type = "div", palette = "RdBu"),

scale_linewidth_continuous("Significance",

range = c(0.25, 3),

# guide_legend(reverse = TRUE): Fat Lines mean higher significance

)

) %>%

gf_refine(guides(linewidth = guide_legend(reverse = TRUE)))We can clearly see that rm and lstat have strong correlations with cmedv and should make good choices for setting up a minimal linear regression model. (medv is the older errored version of cmedv)

We will first execute the lm test with code and evaluate the results. Then we will do an intuitive walk through of the process and finally, hand-calculate entire analysis for clear understanding.

R offers a very simple command lm to execute an Linear Model: Note the familiar formula of stating the variables: (

Call:

lm(formula = cmedv ~ rm, data = housing)

Residuals:

Min 1Q Median 3Q Max

-23.336 -2.425 0.093 2.918 39.434

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -34.6592 2.6421 -13.12 <2e-16 ***

rm 9.0997 0.4178 21.78 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 6.597 on 504 degrees of freedom

Multiple R-squared: 0.4848, Adjusted R-squared: 0.4838

F-statistic: 474.3 on 1 and 504 DF, p-value: < 2.2e-16The model for cmedvcan be written in the form of

- The effect size of

rmon predictingcmedva (slope) value ofrm, we have acmedv. - The F-statistic for the Linear Model is given by

- The

R-squaredvalue isrmis able to explain about half of the trend incmedv; there is substantial variation incmedvthat is still left to explain, an indication that we should perhaps use a richer model, with more predictors. These aspects are explored in the Tutorials.

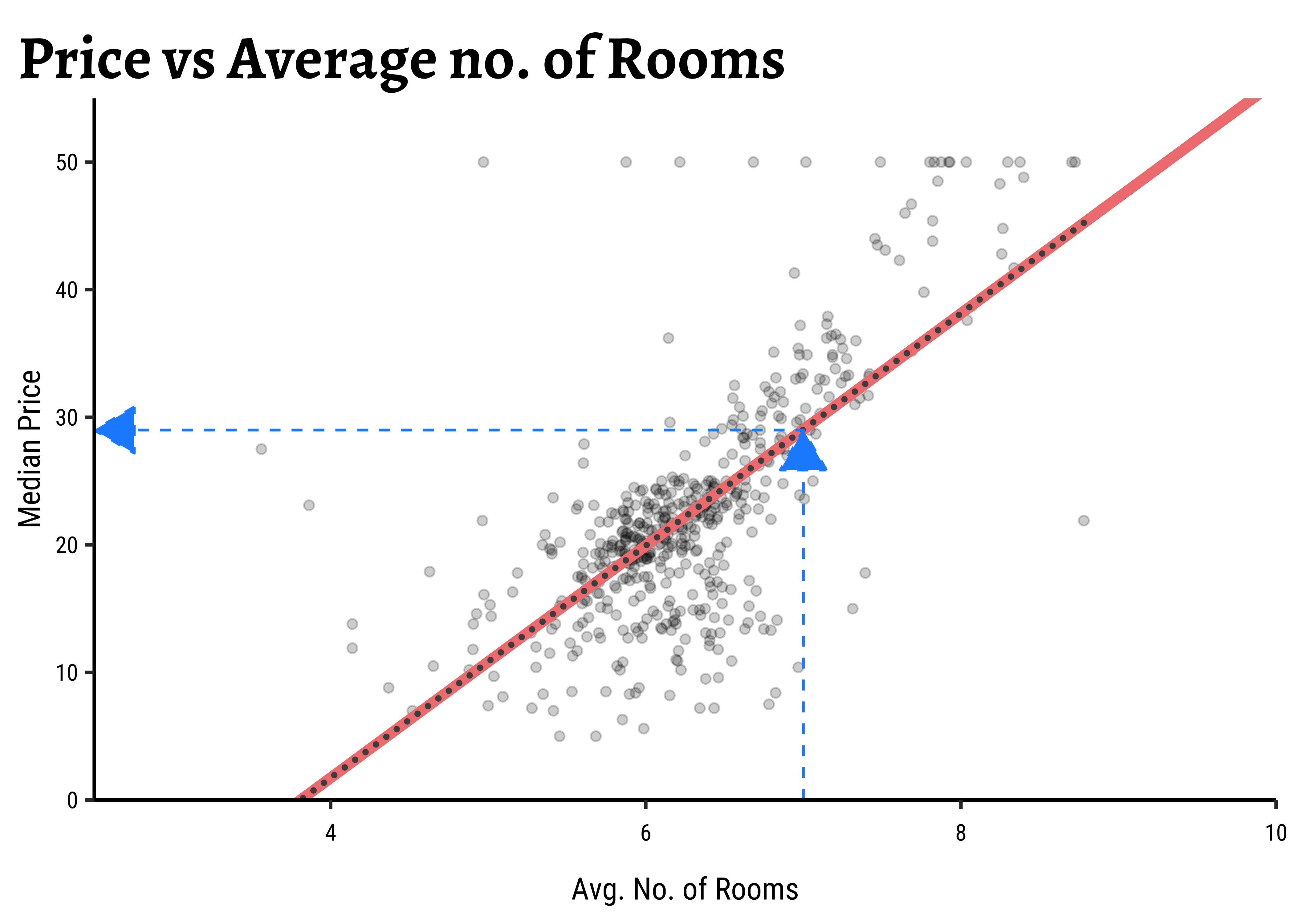

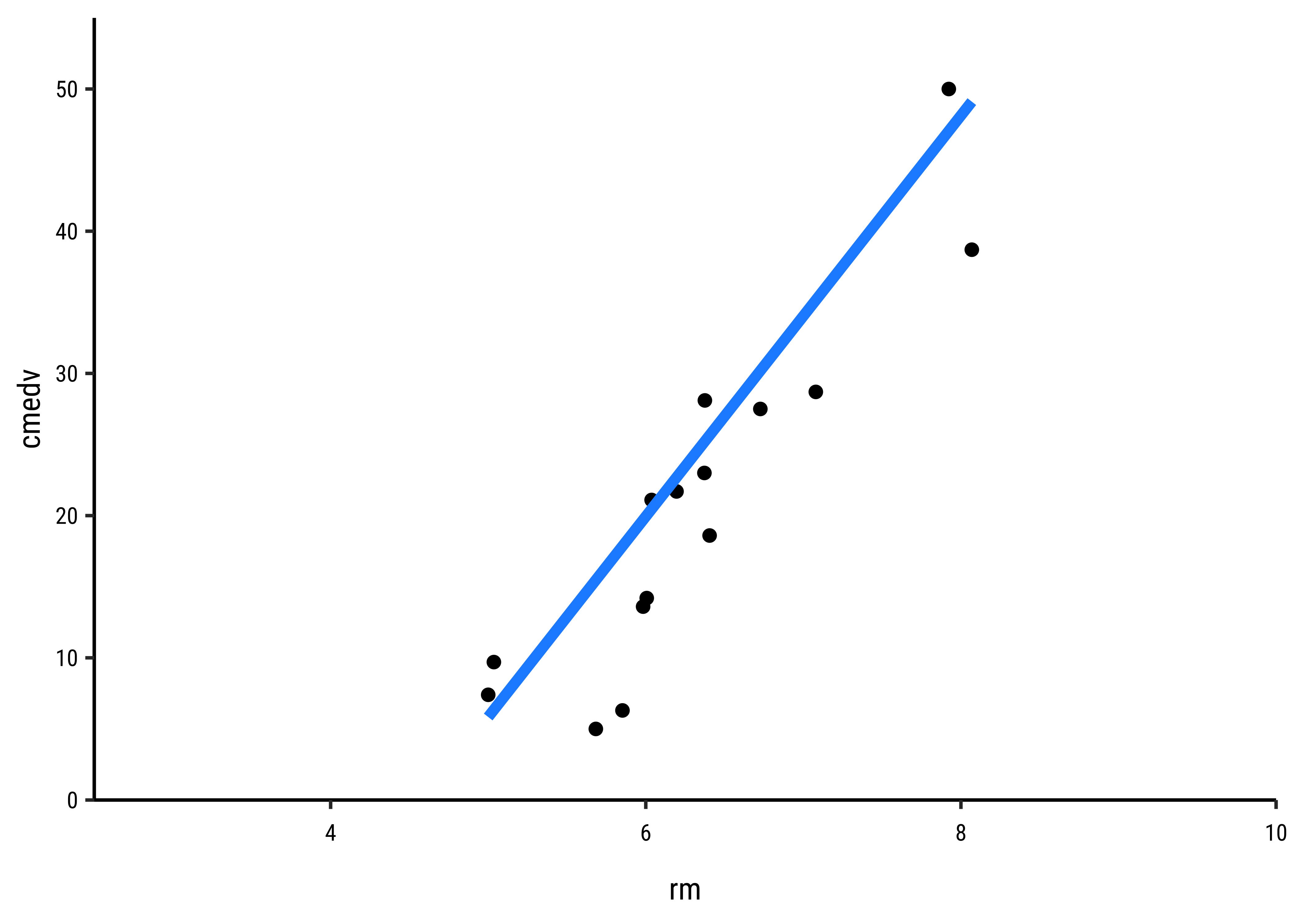

We can plot the scatter plot of these two variables with the model also over-plotted.

#| layout-ncol: 3

#| fig-width: 5

#| fig-height: 4

# Set graph theme

theme_set(new = theme_custom())

#

# Tidy Data frame for the model using `broom`

housing_lm_tidy <-

housing_lm %>%

broom::tidy(

conf.int = TRUE,

conf.level = 0.95

)

housing_lm_tidyterm <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> | conf.low <dbl> | conf.high <dbl> |

|---|---|---|---|---|---|---|

| (Intercept) | -34.65924 | 2.6421358 | -13.11789 | 4.992332e-34 | -39.850200 | -29.468287 |

| rm | 9.09967 | 0.4178141 | 21.77923 | 1.307493e-74 | 8.278798 | 9.920542 |

##

housing_lm_augment <-

housing_lm %>%

broom::augment(

se_fit = TRUE,

interval = "confidence"

)

housing_lm_augmentcmedv <dbl> | rm <dbl> | .fitted <dbl> | .lower <dbl> | .upper <dbl> | .se.fit <dbl> | .resid <dbl> | .hat <dbl> | .sigma <dbl> | |

|---|---|---|---|---|---|---|---|---|---|

| 24.0 | 6.575 | 25.1710849 | 24.547542 | 25.79462741 | 0.3173758 | -1.17108491 | 0.002314475 | 6.603363 | |

| 21.6 | 6.421 | 23.7697358 | 23.182775 | 24.35669693 | 0.2987563 | -2.16973578 | 0.002050875 | 6.602860 | |

| 34.7 | 7.185 | 30.7218834 | 29.784739 | 31.65902770 | 0.4769954 | 3.97811659 | 0.005227973 | 6.601175 | |

| 33.4 | 6.998 | 29.0202452 | 28.198723 | 29.84176761 | 0.4181452 | 4.37975482 | 0.004017531 | 6.600670 | |

| 36.2 | 7.147 | 30.3760960 | 29.463351 | 31.28884111 | 0.4645765 | 5.82390404 | 0.004959290 | 6.598437 | |

| 28.7 | 6.430 | 23.8516328 | 23.263218 | 24.44004757 | 0.2994962 | 4.84836719 | 0.002061045 | 6.600024 | |

| 22.9 | 6.012 | 20.0479709 | 19.429846 | 20.66609597 | 0.3146184 | 2.85202911 | 0.002274433 | 6.602343 | |

| 22.1 | 6.172 | 21.5039180 | 20.920359 | 22.08747752 | 0.2970249 | 0.59608196 | 0.002027172 | 6.603517 | |

| 16.5 | 5.631 | 16.5809967 | 15.793673 | 17.36832076 | 0.4007386 | -0.08099675 | 0.003690009 | 6.603569 | |

| 18.9 | 6.004 | 19.9751735 | 19.354641 | 20.59570644 | 0.3158439 | -1.07517353 | 0.002292187 | 6.603396 |

##

intercept <-

housing_lm_tidy %>%

filter(term == "(Intercept)") %>%

select(estimate) %>%

as.numeric()

##

slope <-

housing_lm_tidy %>%

filter(term == "rm") %>%

select(estimate) %>%

as.numeric()

##

housing %>%

drop_na() %>%

gf_point(

cmedv ~ rm,

title = "Price vs Average no. of Rooms",

ylab = "Median Price",

xlab = "Avg. No. of Rooms",

alpha = 0.2

) %>%

# Plot the model equation

gf_abline(

slope = slope, intercept = intercept,

colour = "lightcoral",

linewidth = 2

) %>%

# Plot the model prediction points on the line

gf_smooth(

method = "lm", geom = "point",

color = "grey30",

size = 0.5

) %>%

gf_refine(

annotate(

geom = "segment",

y = 0, yend = 29, x = 7, xend = 7, # manually calculated

linetype = "dashed",

color = "dodgerblue",

arrow = arrow(

angle = 30,

length = unit(0.25, "inches"),

ends = "last",

type = "closed"

)

),

annotate(

geom = "segment",

y = 29, yend = 29, x = 2.5, xend = 7, # manually calculated

linetype = "dashed",

arrow = arrow(

angle = 30,

length = unit(0.25, "inches"),

ends = "first",

type = "closed"

),

color = "dodgerblue"

)

) %>%

gf_refine(

scale_x_continuous(

limits = c(2.5, 10),

expand = c(0, 0)

),

# removes plot panel margins

scale_y_continuous(

limits = c(0, 55),

expand = c(0, 0)

)

) %>%

gf_theme(theme = theme_custom())For any new value of rm, we go up to the vertical blue line and read off the predicted median price by following the horizontal blue line. That is how the model is used (by hand).

In practice, we use the broom package functions (tidy, glance and augment) to obtain a clear view of the model parameters and predictions of cmedv for all existing values of rm. We see estimates for the intercept and slope (rm) for the linear model, along with the standard errors and p.values for these estimated parameters. And we see the fitted values of cmedv for the existing rm; these values will naturally lie on the straight-line depicting the model. We will examine this augment-ed data more the section on Diagnostics.

To predict cmedv with new values of rm, we use predict. Let us now try to make predictions with some new data:

new <- tibble(rm = seq(3, 10)) # must be named "rm"

new %>% mutate(

predictions =

stats::predict(

object = housing_lm,

newdata = .,

se.fit = FALSE

)

)rm <int> | predictions <dbl> |

|---|---|

| 3 | -7.360234 |

| 4 | 1.739436 |

| 5 | 10.839105 |

| 6 | 19.938775 |

| 7 | 29.038445 |

| 8 | 38.138114 |

| 9 | 47.237784 |

| 10 | 56.337454 |

Note that “negative values” for predicted cmedv would have no meaning!

All that is very well, but what is happening under the hood of the lm command? Consider the cmedv (target) variable and the rm feature/predictor variable. What we do is:

- Plot a scatter plot

gf_point(cmedv ~ rm, housing) - Find a line that, in some way, gives us some prediction of

cmedvfor any givenrm - Calculate the errors in prediction and use those to find the “best” line.

- Use that “best” line henceforth as a model for prediction.

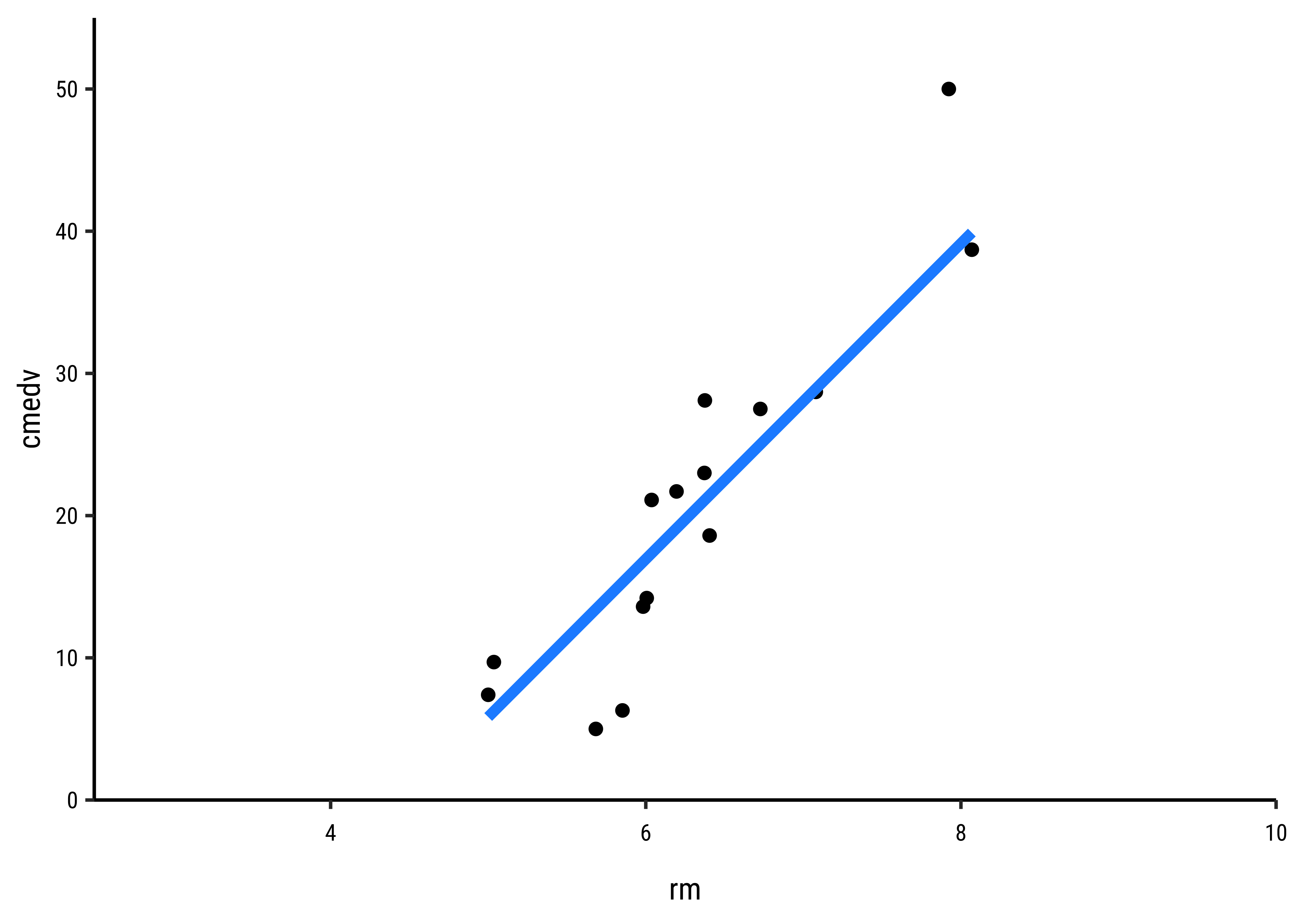

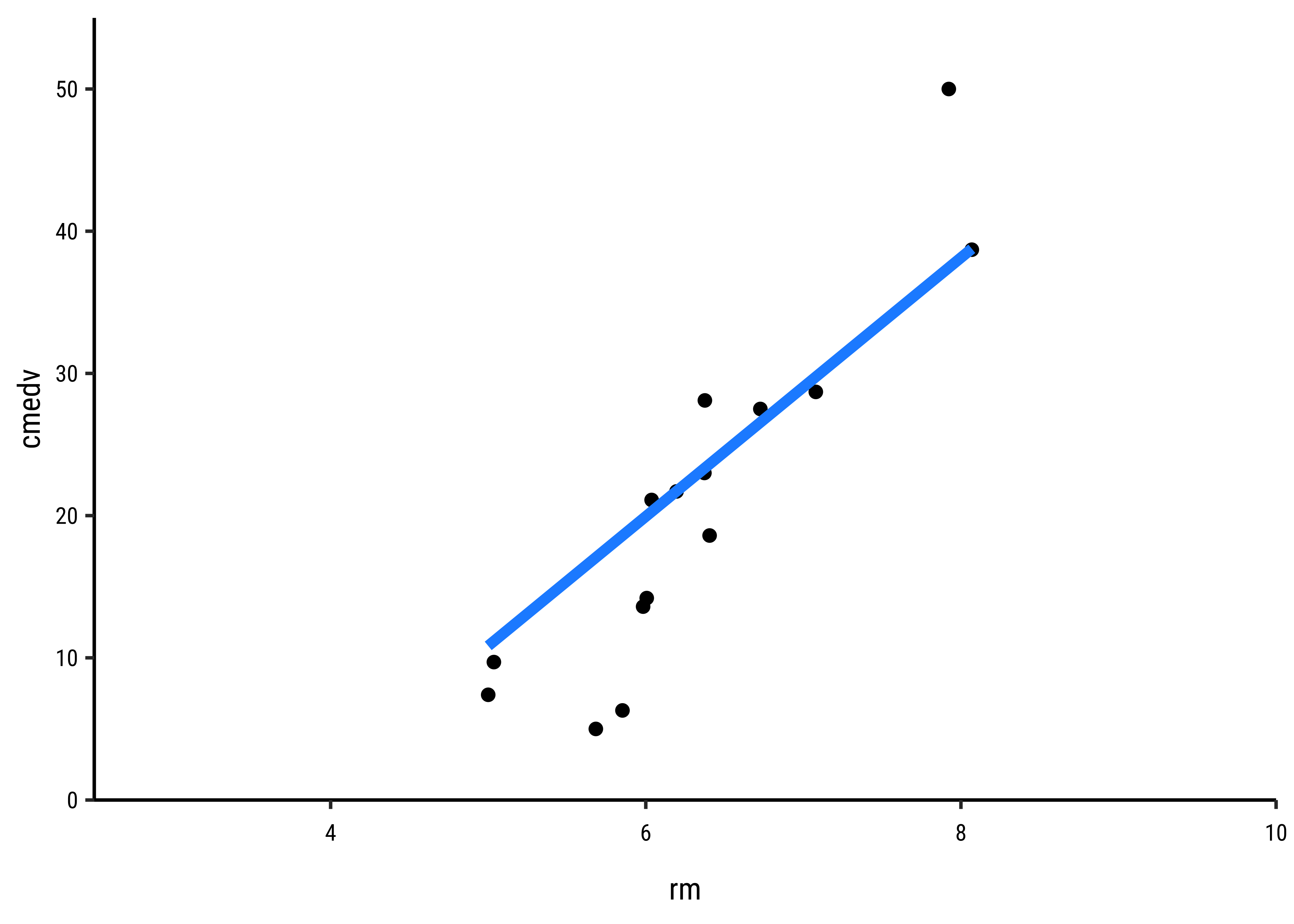

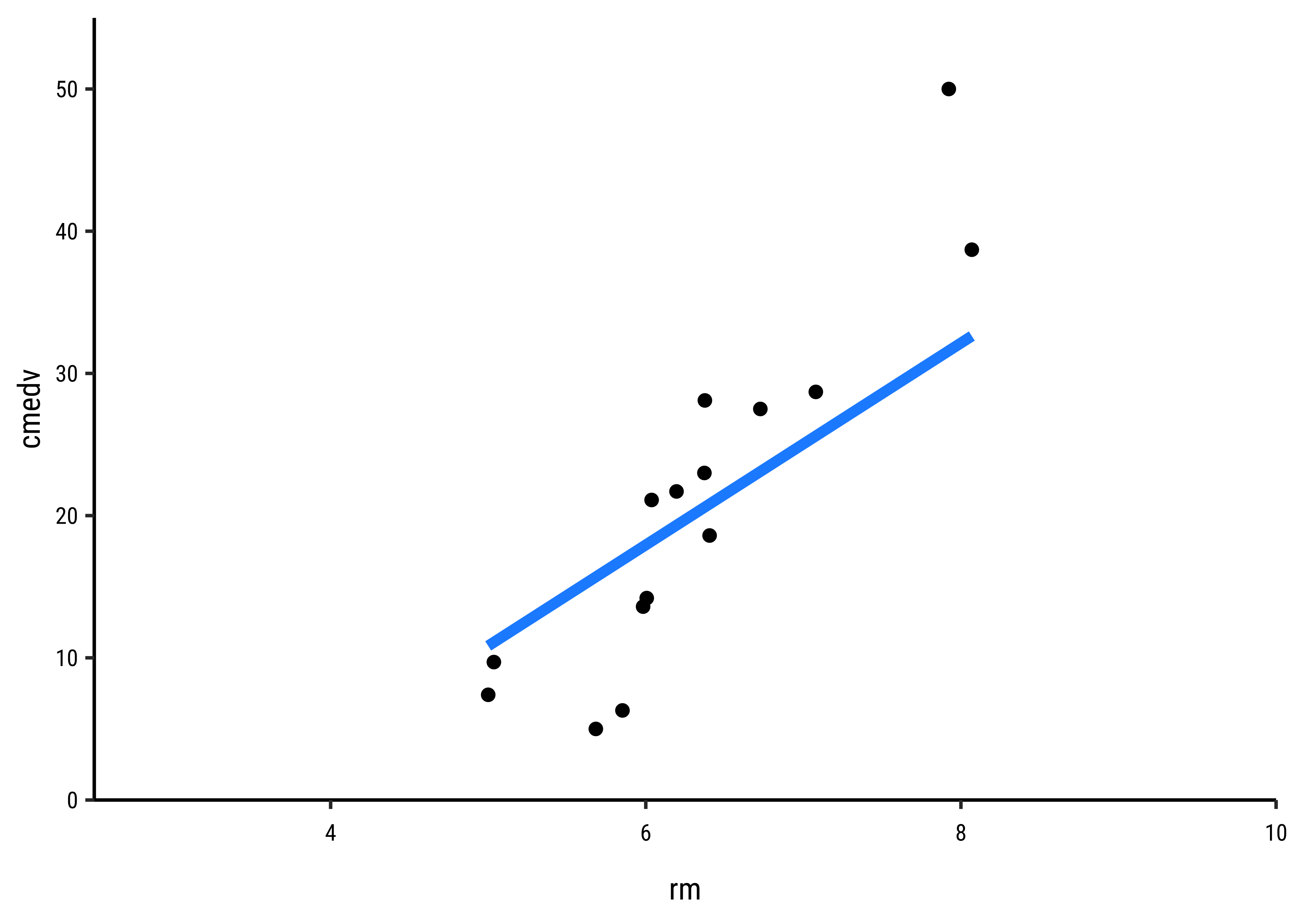

How does one fit the “best” line? Consider a choice of “lines” that we can use to fit to the data. Here are 6 lines of varying slopes (and intercepts ) that we can try as candidates for the best fit line:

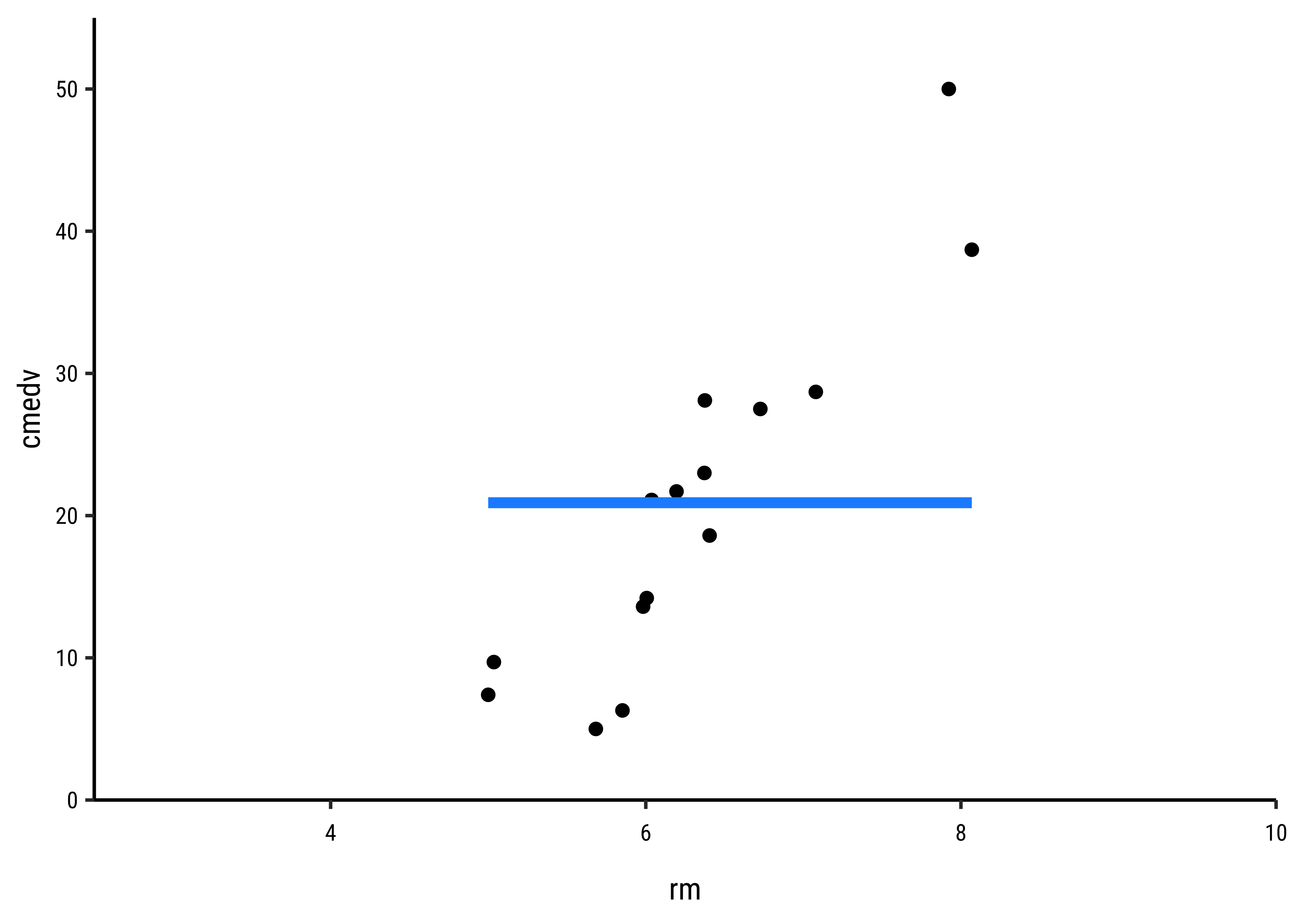

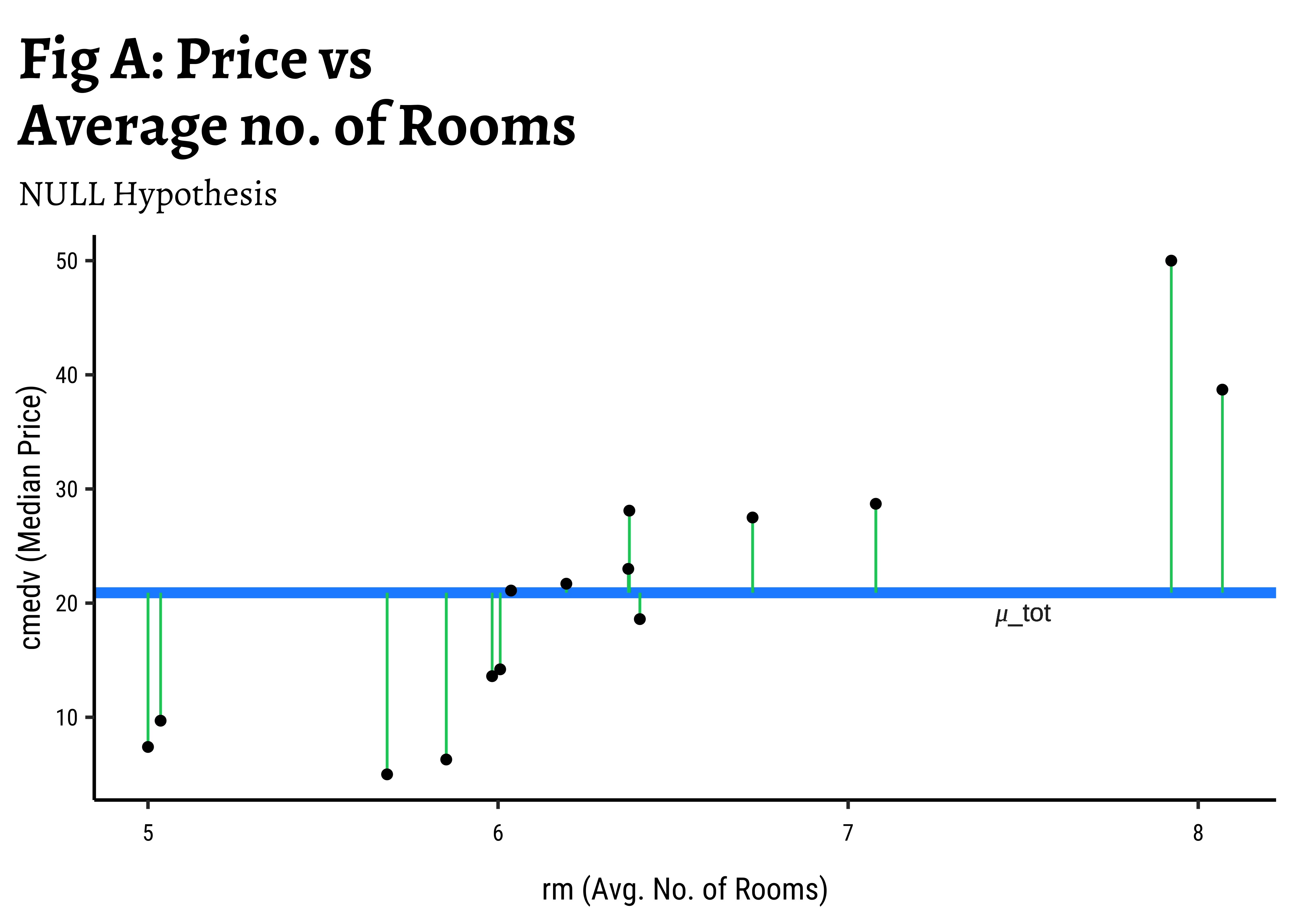

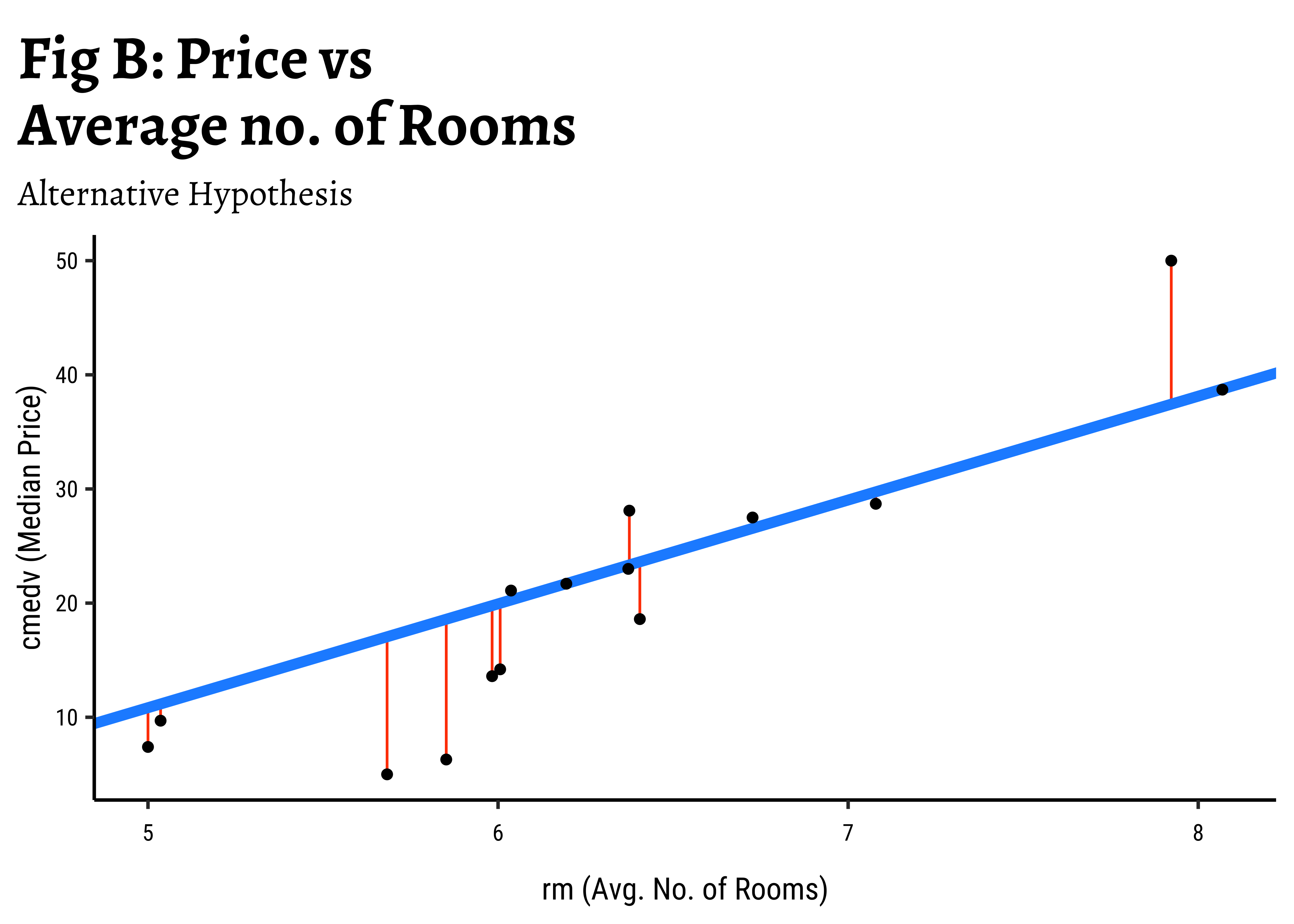

It should be apparent that while we cannot determine which line may be the best, the worst line seems to be the one in the final plot, which ignores the x-variable rm altogether. This corresponds to the NULL Hypothesis, that there is no relationship between the two variables. Any of the other lines could be a decent candidate, so how do we decide?

In Fig A, the horizontal blue line is the overall mean of cmedv, denoted as

In Fig B, the vertical red lines are the residuals of each point from the potential line of fit. The sum of the squares of these lines is called the Total Error Sum of Squares (SSE).

It should be apparent that if there is any positive linear relationship between cmedv and rm,then

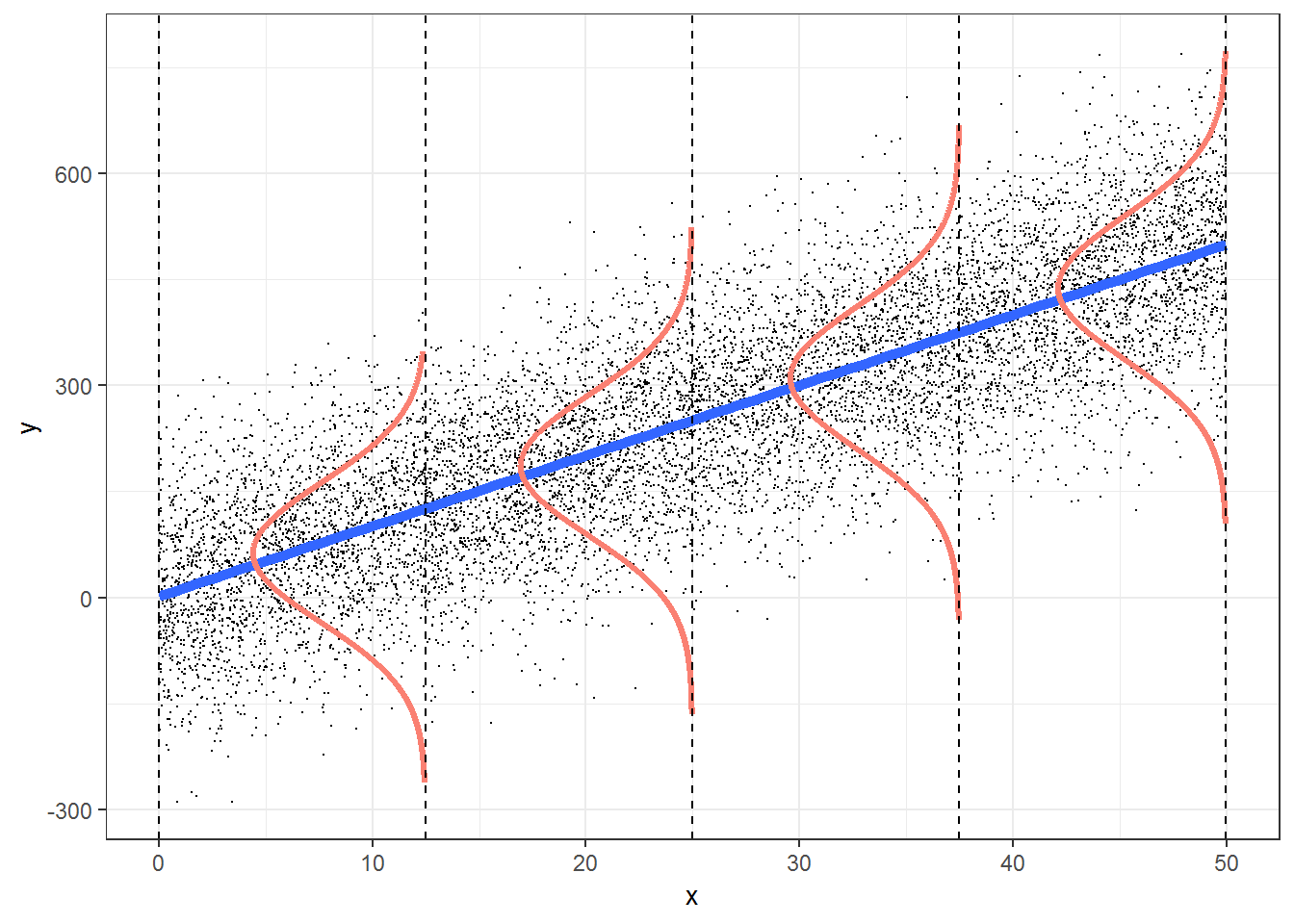

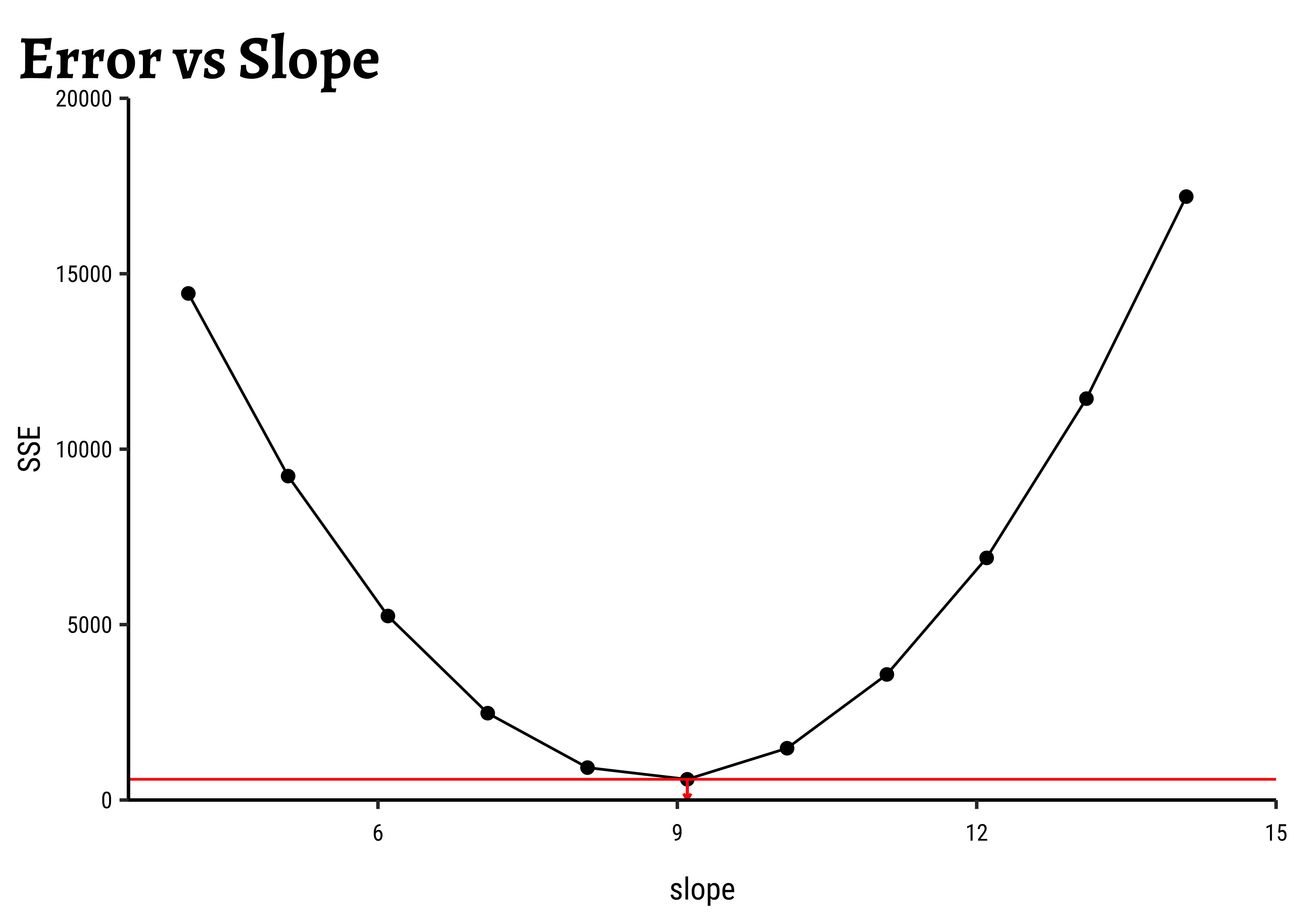

How do we get the optimum slope + intercept? If we plot the

#| echo: false

sim_model <- tibble(

b = slope + seq(-5, 5),

a = intercept,

dat = list(tibble(

cmedv = housing_sample$cmedv,

rm = housing_sample$rm

))

) %>%

mutate(r_squared = pmap_dbl(

.l = list(a, b, dat),

.f = \(a, b, dat) sum((dat$cmedv - (b * dat$rm + a))^2)

))

min_r_squared <- sim_model %>%

select(r_squared) %>%

min()

min_slope <- sim_model %>%

filter(r_squared == min_r_squared) %>%

select(b) %>%

as.numeric()

sim_model %>%

gf_point(r_squared ~ b, data = ., size = 2) %>%

gf_line(ylab = "SSE", xlab = "slope", title = "Error vs Slope") %>%

gf_hline(yintercept = min_r_squared, color = "red") %>%

gf_segment(min_r_squared + 0 ~ min_slope + min_slope,

colour = "red",

arrow = arrow(ends = "last", length = unit(1, "mm"))

) %>%

gf_refine(

coord_cartesian(expand = FALSE),

expand_limits(y = c(0, 20000), x = c(3.5, 15))

)We see that there is a quadratic minimum lm does.

Let us hand-calculate the numbers so we know what the test is doing. Here is the SST: we pretend that there is no relationship between cmedv ans rm and compute a NULL model:

And here is the SSE:

SSE <- deviance(housing_lm)

SSE[1] 21934.39Given that the model leaves unexplained variations in cmedv to the extent of cmedv that the linear model does explain:

SSR <- SST - SSE

SSR[1] 20643.35We have

In order to calculate the F-Statistic, we need to compute the variances, using these sum of squares. We obtain variances by dividing by their Degrees of Freedom:

where

Let us calculate these Degrees of Freedom. If we have

-

-

- And therefore

Now we are ready to compute the F-statistic:

n <- housing %>%

count() %>%

as.numeric()

df_SSR <- 1

df_SSE <- n - 2

F_stat <- (SSR / df_SSR) / (SSE / df_SSE)

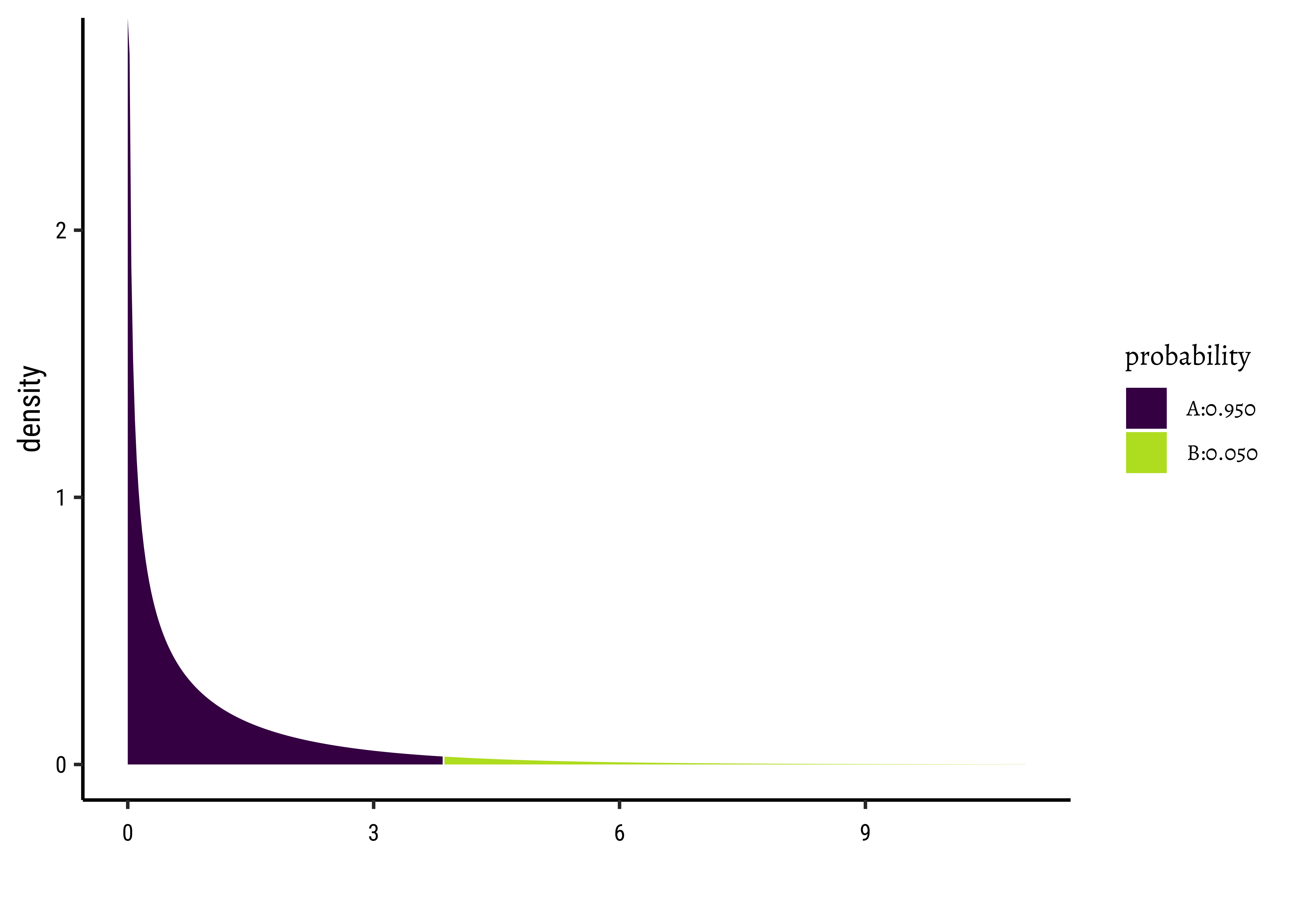

F_stat[1] 474.3349The F-stat is compared with a critical value of the F-statistic, which is computed using the formula for the f-distribution in R. As with our hypothesis tests, we set the significance level to 0.95, and quote the two relevant degrees of freedom as parameters to qf() which computes the critical F value as a quartile:

F_crit <- qf(

p = 0.95, # Significance level is 5%

df1 = df_SSR, # Numerator degrees of freedom

df2 = df_SSE

) # Denominator degrees of freedom

F_crit[1] 3.859975F_stat[1] 474.3349The F_crit value can also be seen in a plot2:

Any value of F more than the rm has a significant effect on cmedv.

The value of R.squared is also calculated from the previously computed sums of squares:

r_squared <- (SST - SSE) / SST

r_squared[1] 0.484839# Also computable by

# mosaic::rsquared(housing_lm)So R.squared = 0.484839

The value of Slope and Intercept are computed using a maximum likelihood derivation and the knowledge that the means square error is a minimum at the optimum slope: for a linear model

Note that the slope is equal to the ratio of the covariance of x and y to the variance of x.

and

[1] 9.09967##

intercept <- mosaic::mean(~cmedv, data = housing) - slope * mosaic::mean(~rm, data = housing)

intercept[1] -34.65924So, there we are! All of this is done for us by one simple formula, lm()!

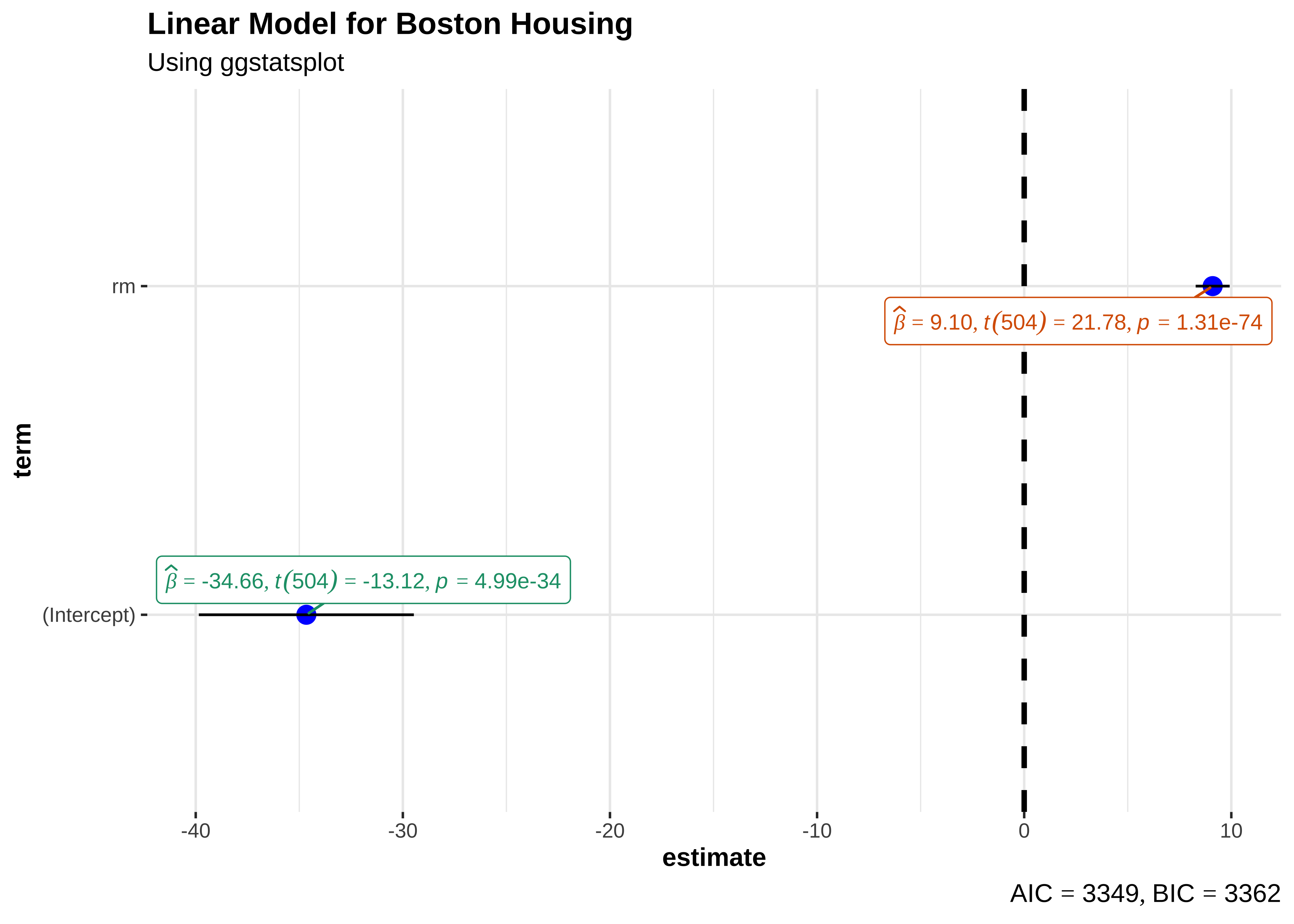

There is a very neat package called ggstatsplot3 that allows us to plot very comprehensive statistical graphs. Let us quickly do this:

library(ggstatsplot)

housing_lm %>%

ggstatsplot::ggcoefstats(

title = "Linear Model for Boston Housing",

subtitle = "Using ggstatsplot"

)This chart shows the estimates for the intercept and rm along with their error bars, the t-statistic, degrees of freedom, and the p-value.

We can also obtain crisp-looking model tables from the new supernova package 4, which is based on the methods discussed in Judd et al.

Analysis of Variance Table (Type III SS)

Model: cmedv ~ rm

SS df MS F PRE p

----- --------------- | --------- --- --------- ------- ----- -----

Model (error reduced) | 20643.347 1 20643.347 474.335 .4848 .0000

Error (from model) | 21934.392 504 43.521

----- --------------- | --------- --- --------- ------- ----- -----

Total (empty model) | 42577.739 505 84.312 This table is very neat in that it gives the Sums of Squares for both the NULL (empty) model, and the current model for comparison. The PRE entry is the Proportional Reduction in Error, a measure that is identical with r.squared, which shows how much the model reduces the error compared to the NULL model(48%). The PRE idea is nicely discussed in Judd et al Section 10.

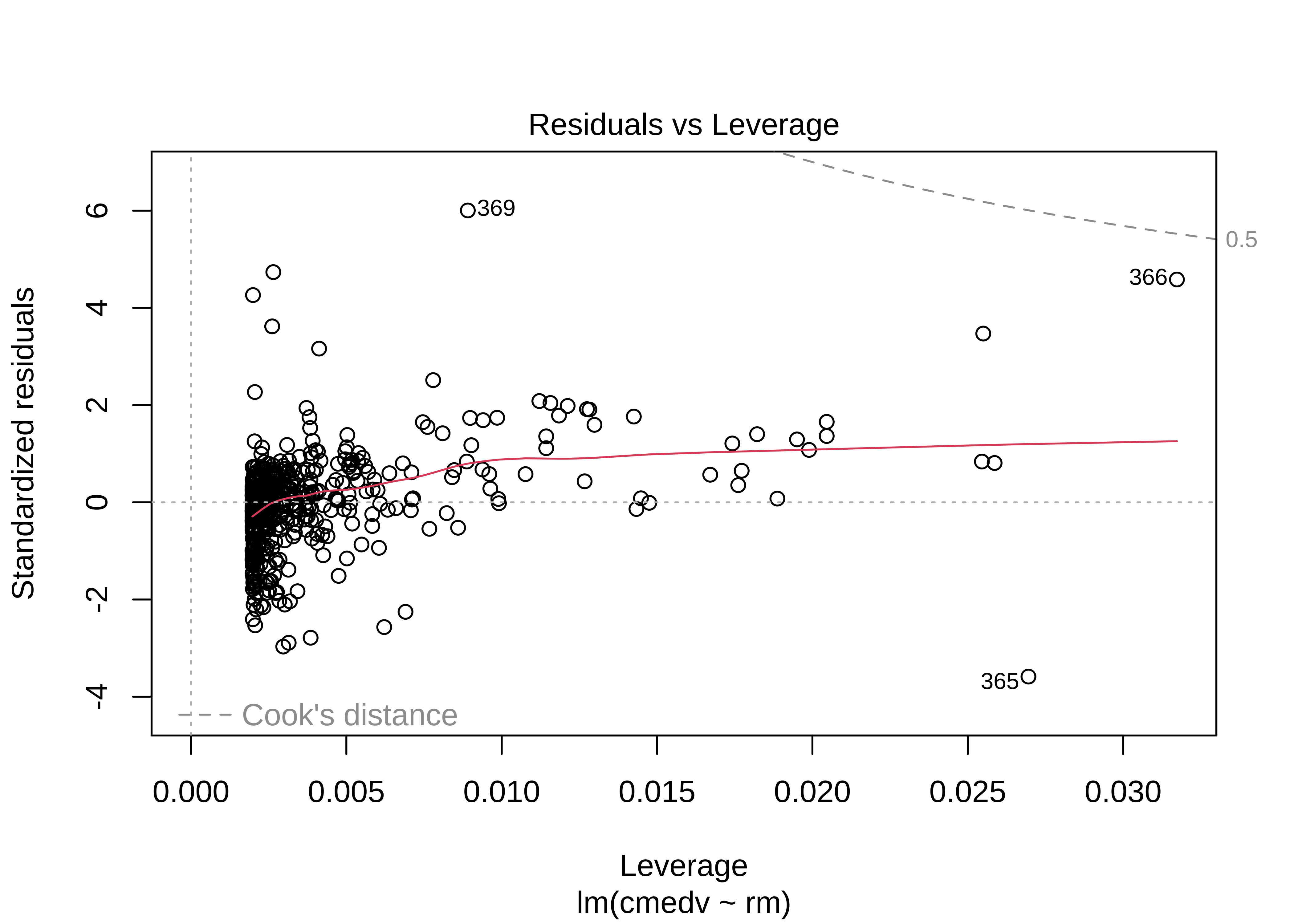

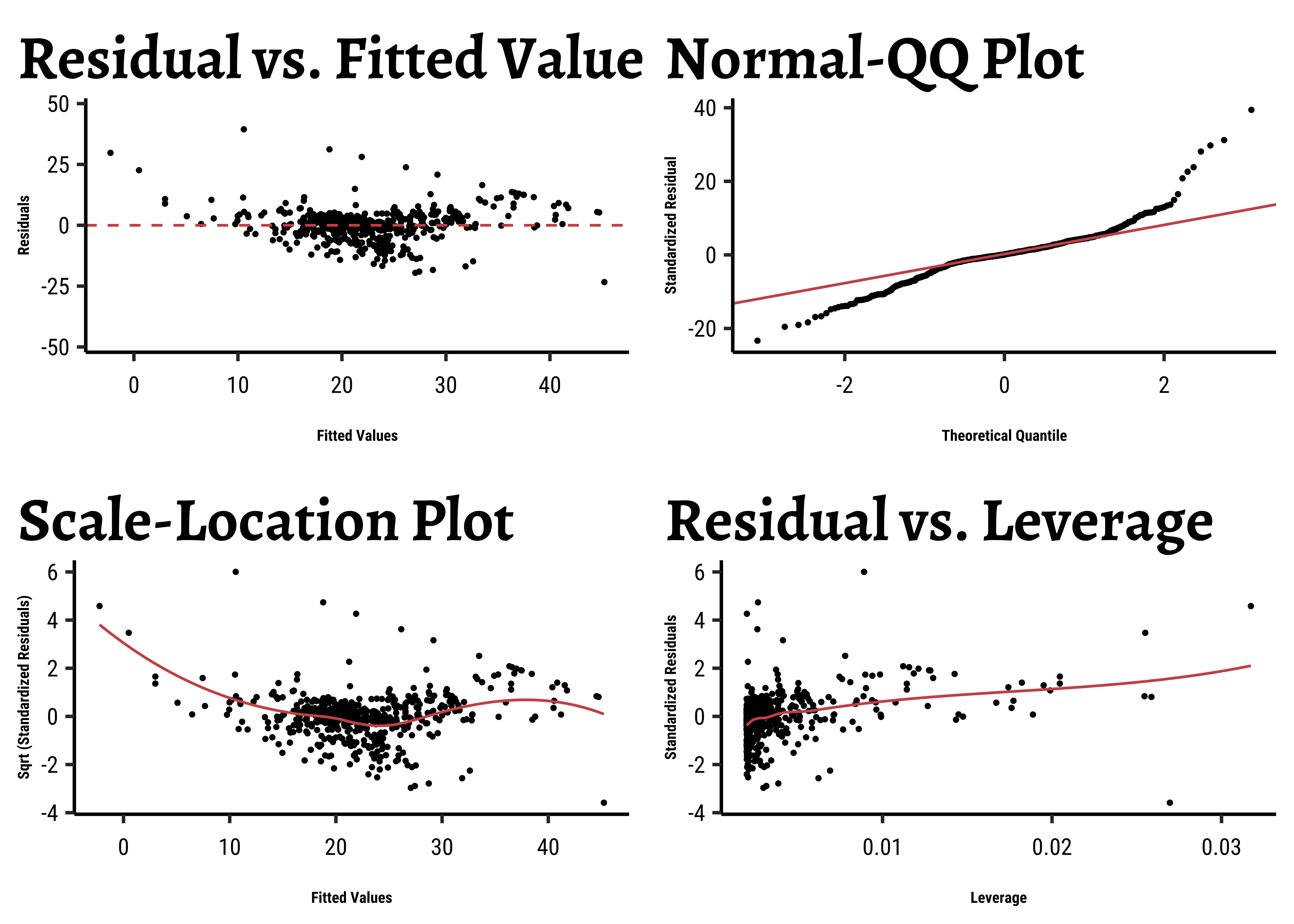

We will follow much of the treatment on Linear Model diagnostics, given here on the STHDA website.

A first step of this regression diagnostic is to inspect the significance of the regression beta coefficients, as well as, the R.square that tells us how well the linear regression model fits to the data.

For example, the linear regression model makes the assumption that the relationship between the predictors (x) and the outcome variable is linear. This might not be true. The relationship could be polynomial or logarithmic.

Additionally, the data might contain some influential observations, such as outliers (or extreme values), that can affect the result of the regression.

Therefore, the regression model must be closely diagnosed in order to detect potential problems and to check whether the assumptions made by the linear regression model are met or not. To do so, we generally examine the distribution of residuals errors, that can tell us more about our data.

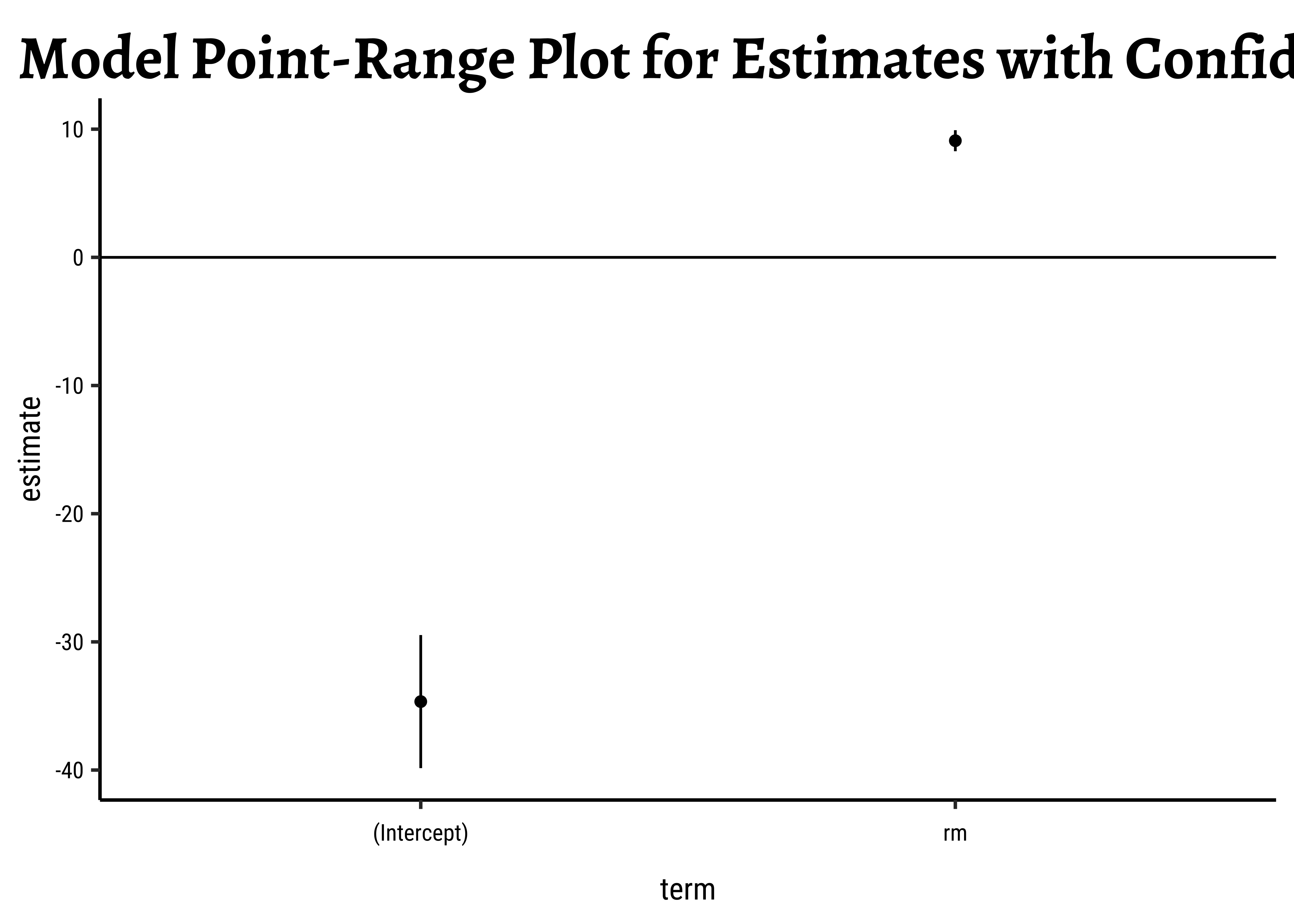

Let us first look at the uncertainties in the estimates of slope and intercept. These are most easily read off from the broom::tidy-ed model:

# housing_lm_tidy <- housing_lm %>% broom::tidy()

housing_lm_tidyterm <chr> | estimate <dbl> | std.error <dbl> | statistic <dbl> | p.value <dbl> | conf.low <dbl> | conf.high <dbl> |

|---|---|---|---|---|---|---|

| (Intercept) | -34.65924 | 2.6421358 | -13.11789 | 4.992332e-34 | -39.850200 | -29.468287 |

| rm | 9.09967 | 0.4178141 | 21.77923 | 1.307493e-74 | 8.278798 | 9.920542 |

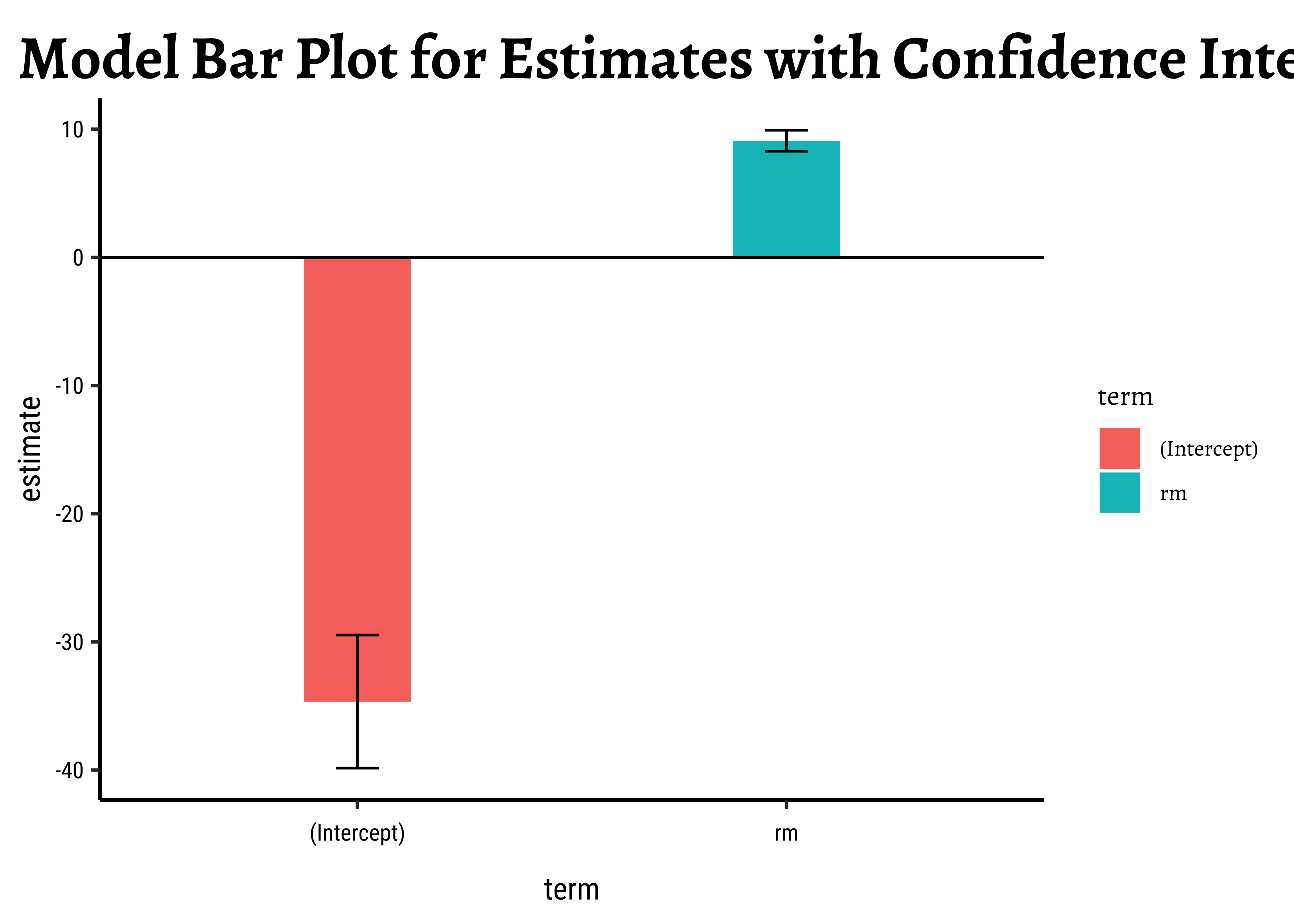

Plotting this is simple too:

# Set graph theme

theme_set(new = theme_custom())

#

housing_lm_tidy %>%

gf_col(estimate ~ term, fill = ~term, width = 0.25) %>%

gf_hline(yintercept = 0) %>%

gf_errorbar(conf.low + conf.high ~ term,

width = 0.1,

title = "Model Bar Plot for Estimates with Confidence Intervals"

) %>%

gf_theme(theme = theme_custom())

##

housing_lm_tidy %>%

gf_pointrange(estimate + conf.low + conf.high ~ term,

title = "Model Point-Range Plot for Estimates with Confidence Intervals"

) %>%

gf_hline(yintercept = 0) %>%

gf_theme(theme = theme_custom())The point-range plot helps to avoid what has been called “within-the-bar bias”. The estimate is just a value, which we might plot as a bar or as a point, with uncertainty error-bars.

Values within the bar are not more likely!! This is the bias that the point-range plot avoids.

Linear Modelling makes 4 fundamental assumptions:(“LINE”)

- Linear relationship between y and x

- Observations are independent.

- Residuals are normally distributed

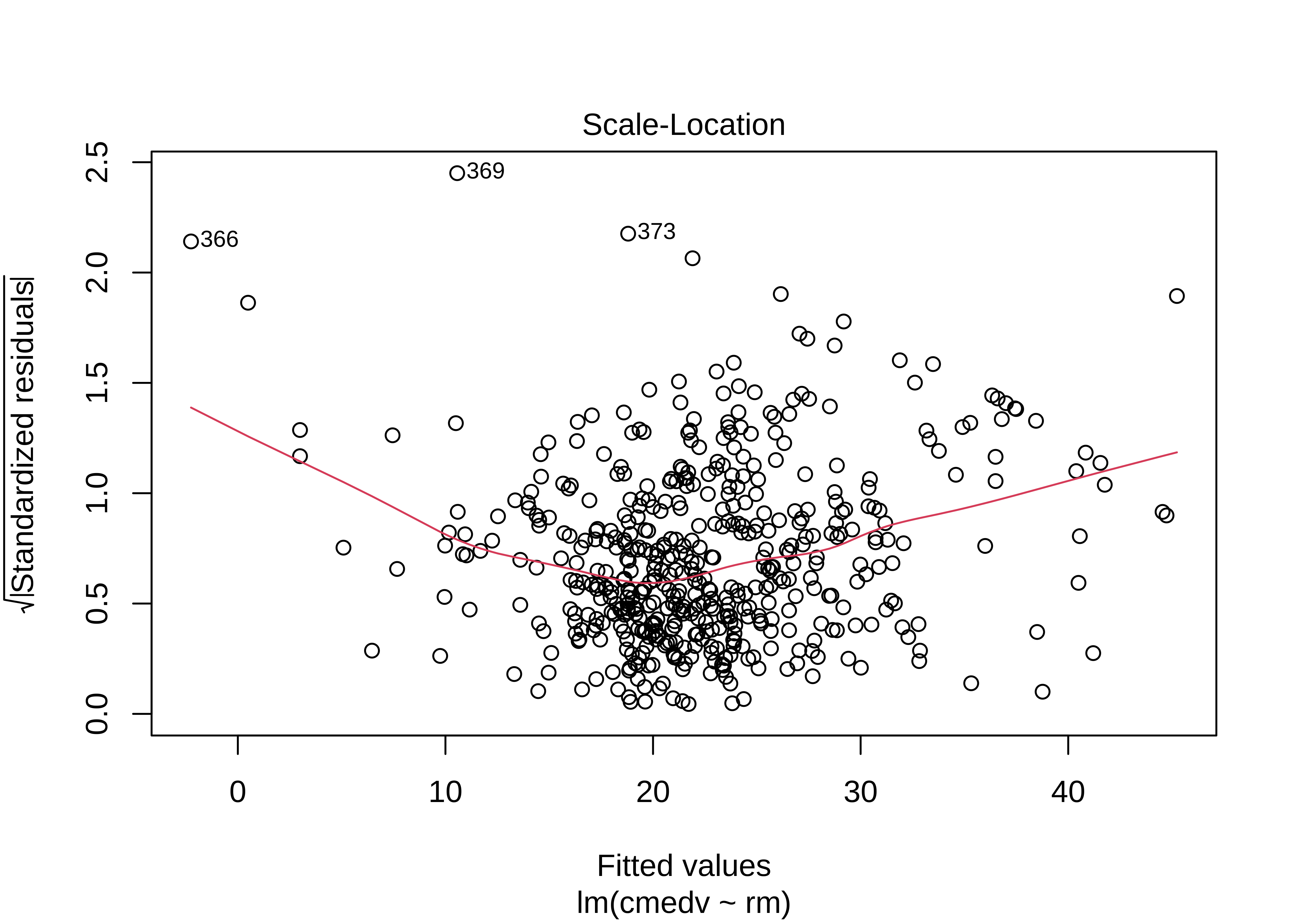

- Variance of the

yvariable is equal at all values ofx.

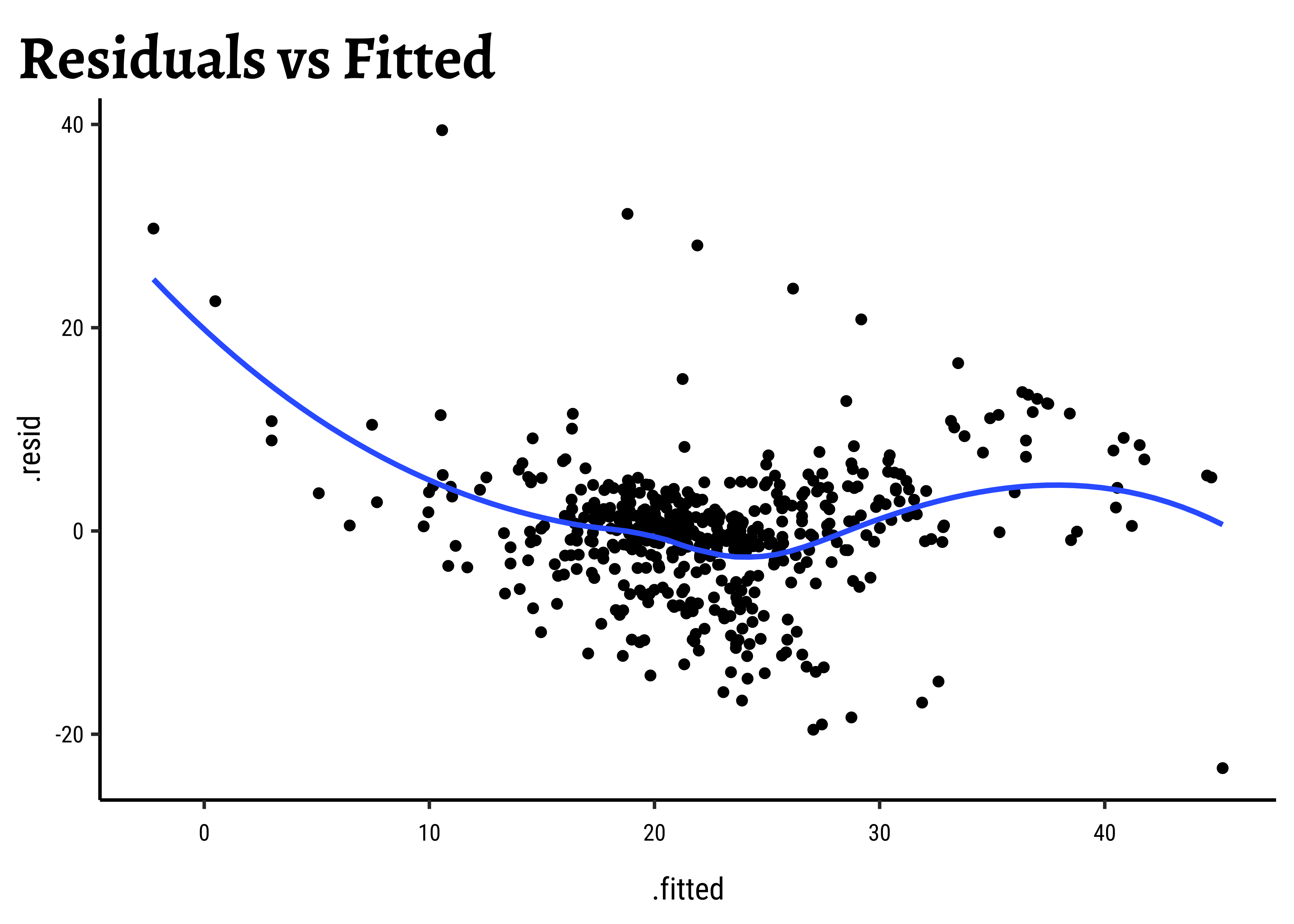

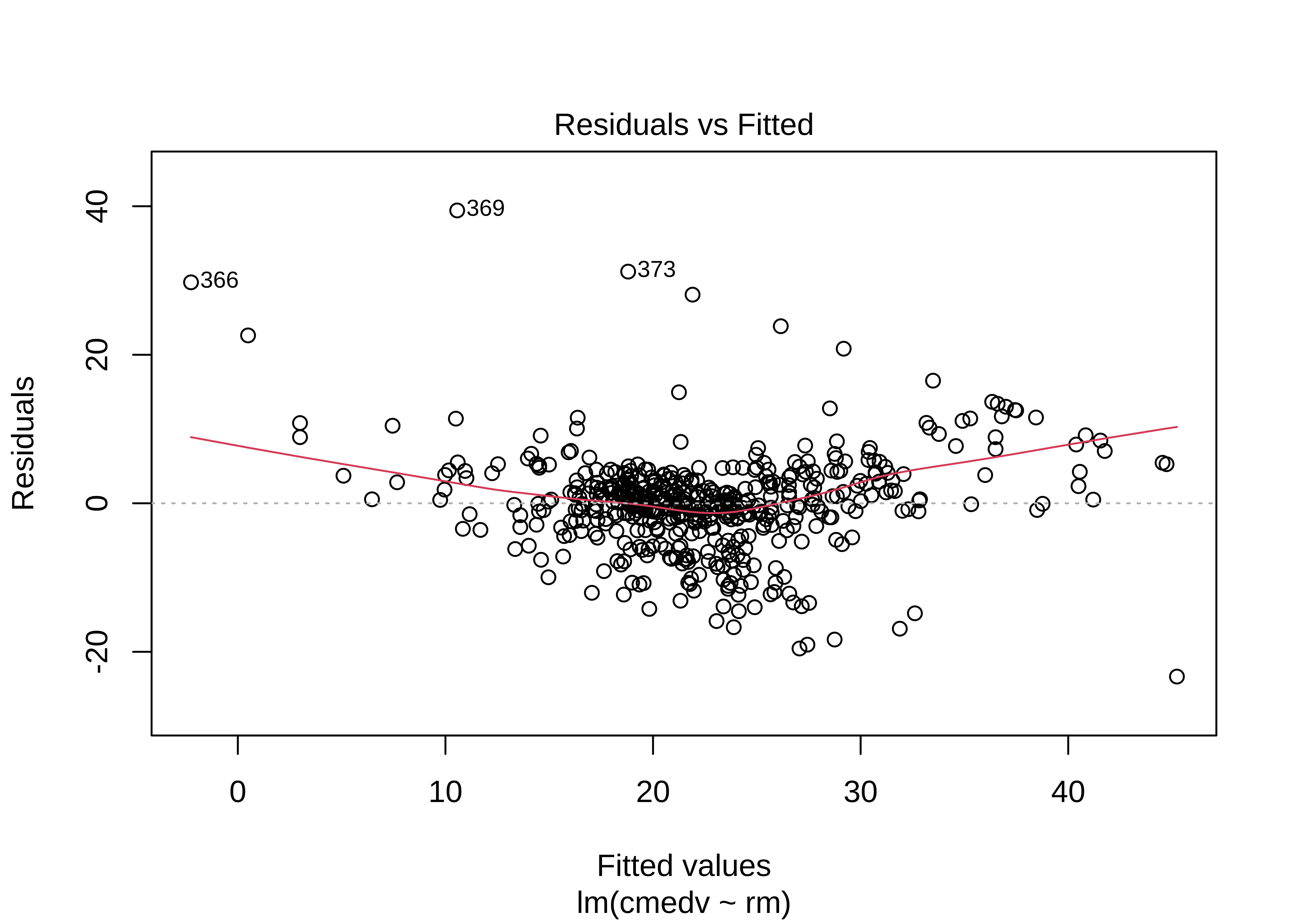

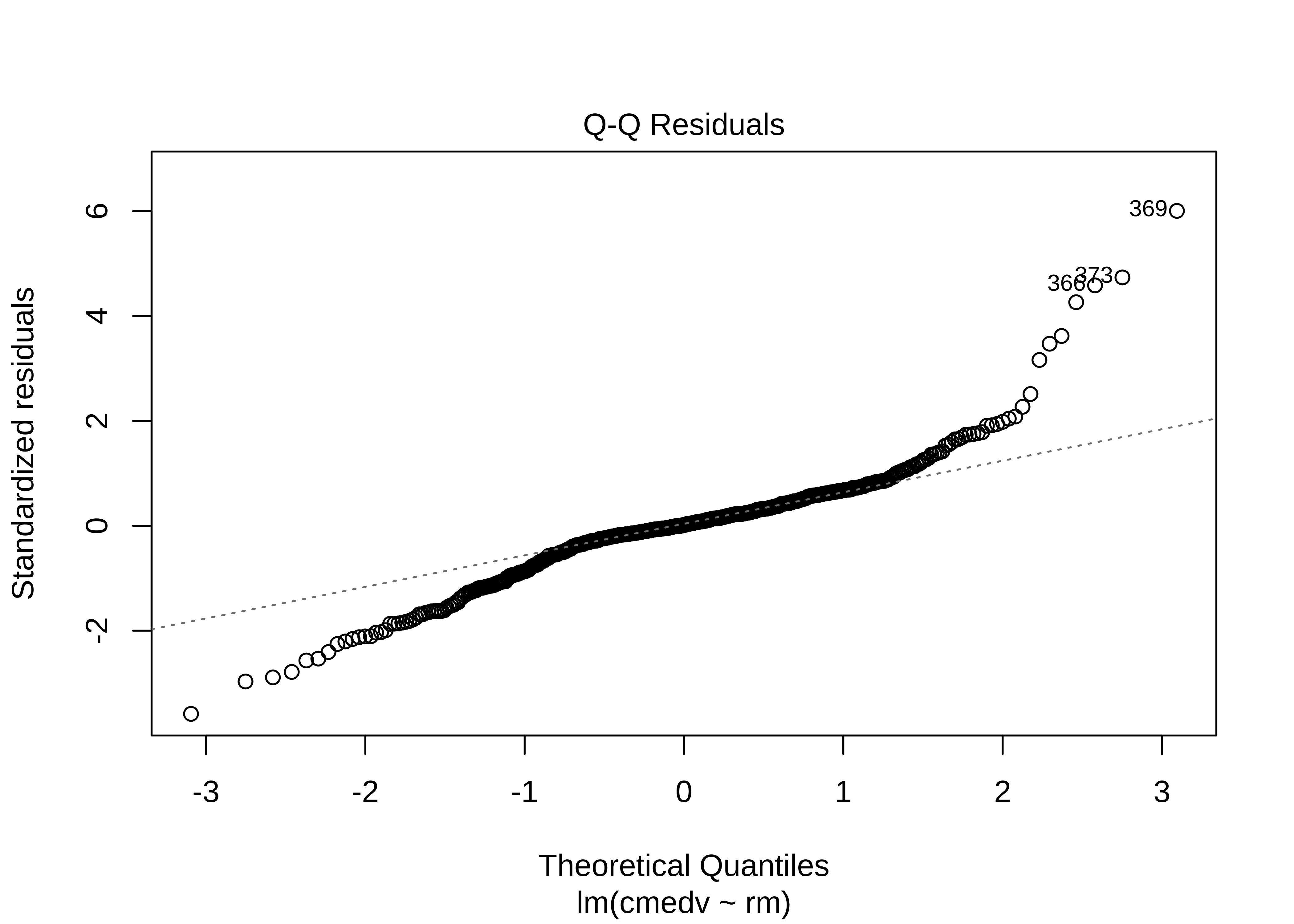

We can check these using checks and graphs: Here we plot the residuals against the independent/feature variable and see if there is a gross variation in their range

housing_lm_augment %>%

gf_point(.resid ~ .fitted, title = "Residuals vs Fitted") %>%

gf_smooth(method = "loess")

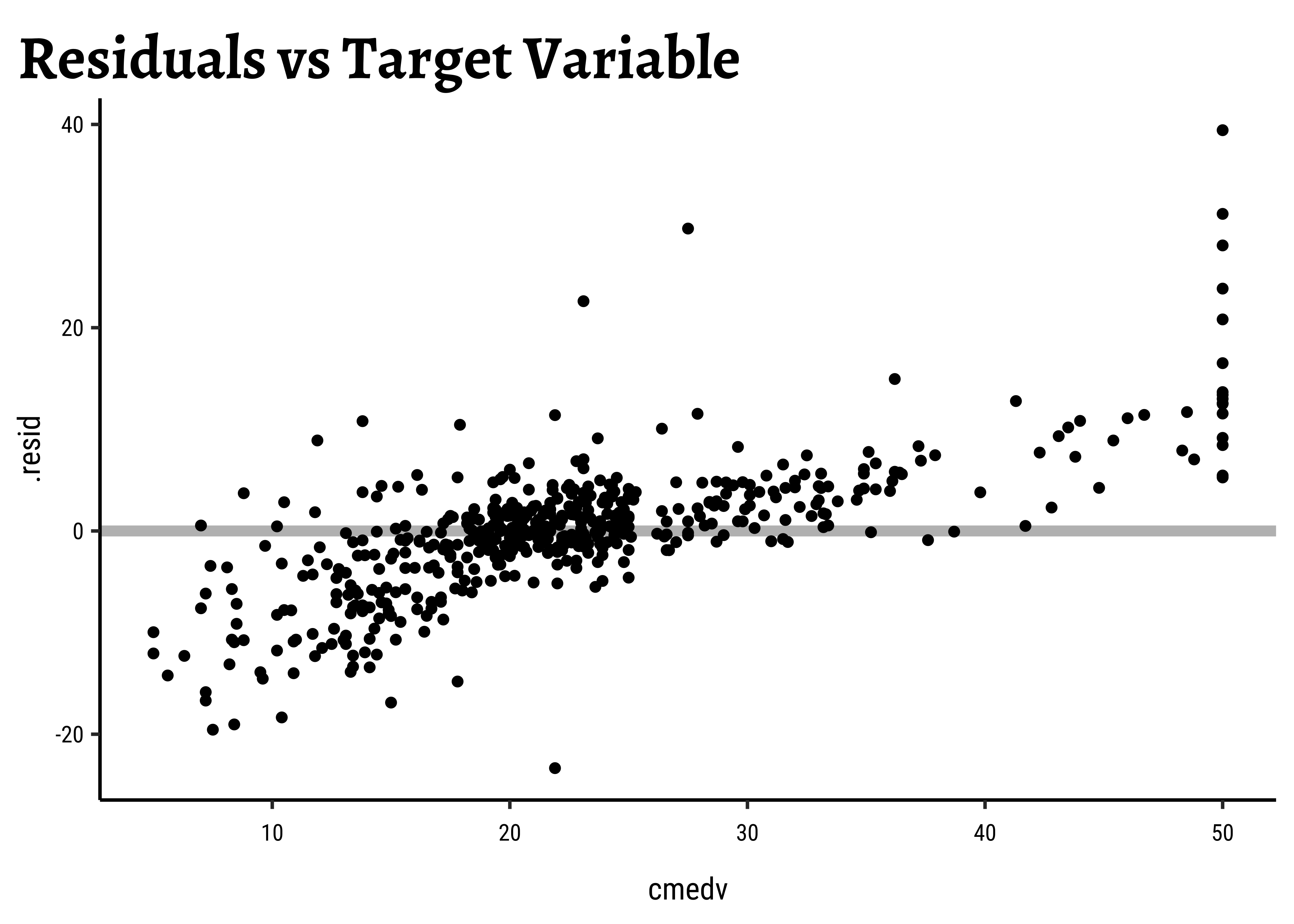

housing_lm_augment %>%

gf_hline(yintercept = 0, colour = "grey", linewidth = 2) %>%

gf_point(.resid ~ cmedv, title = "Residuals vs Target Variable")

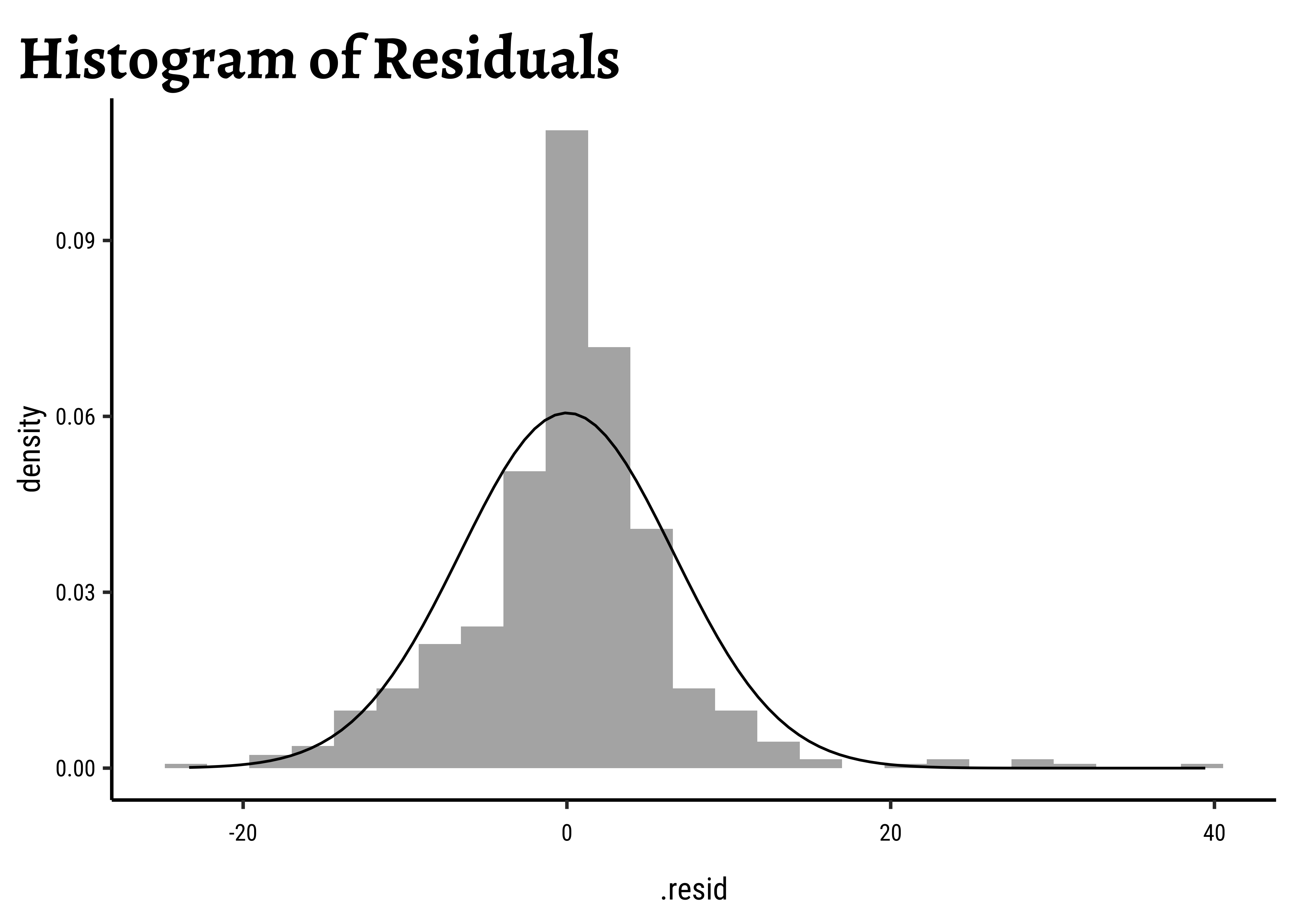

housing_lm_augment %>%

gf_dhistogram(~.resid, title = "Histogram of Residuals") %>%

gf_fitdistr()

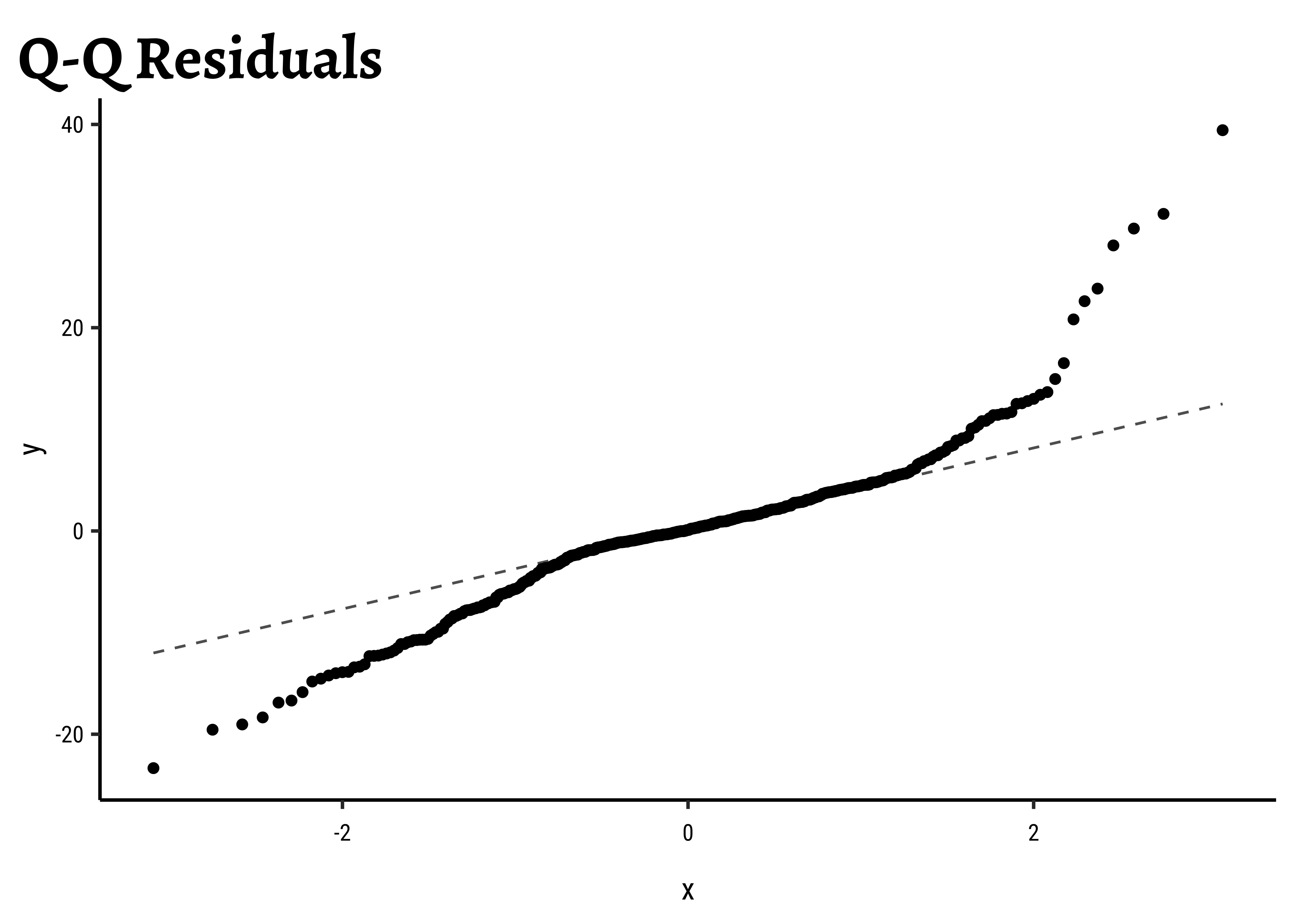

housing_lm_augment %>%

gf_qq(~.resid, title = "Q-Q Residuals") %>%

gf_qqline()The Q-Q plot of residuals also has significant deviations from the normal quartiles. The residuals are not quite “like the night sky”, i.e. random enough. These point to the need for a richer model, with more predictors. The “trend line” of residuals vs predictors show a U-shaped pattern, indicating significant nonlinearity: there is a curved relationship in the graph. The solution can be a nonlinear transformation of the predictor variables, such as cmedv using rm as we have done. This will still be a linear model!

Base R has a crisp command to plot these diagnostic graphs. But we will continue to use ggformula.

plot(housing_lm)One of the ggplot extension packages named lindia also has a crisp command to plot these diagnostic graphs.

# Set graph theme

theme_set(new = theme_custom())

#

library(lindia)

gg_diagnose(housing_lm,

mode = "base_r", # plots like those with base-r

theme = theme(

axis.title = element_text(size = 6, face = "bold"),

title = element_text(size = 8)

)

)The r-squared for a model lm(cmedv ~ rm^2) shows some improvement:

[1] 0.5501221Extras

It is also possible that there is more than one explanatory variable: this is multiple regression.

where each of the

but not, for example, these:

There are three ways5 to include more predictors:

- Backward Selection: We would typically start with a maximal model6 and progressively simplify the model by knocking off predictors that have the least impact on model accuracy.

- Forward Selection: Start with no predictors and systematically add them one by one to increase the quality of the model

- Mixed Selection: Wherein we start with no predictors and add them to gain improvement, or remove them at as their significance changes based on other predictors that have been added.

The first two are covered in the other tutorials above; Mixed Selection we will leave for a more advanced course. But for now we will first use just one predictor rm(Avg. no. of Rooms) to model housing prices.

We have seen how starting from a basic EDA of the data, we have been able to choose a single Quantitative predictor variable to model a Quantitative target variable, using Linear Regression. As stated earlier, we may have wish to use more than one predictor variables, to build more sophisticated models with improved prediction capability. And there is more than one way of selecting these predictor variables, which we will examine in the Tutorials.

Secondly, sometimes it may be necessary to mathematically transform the variables in the dataset to enable the construction of better models, something that was not needed here.

We may also encounter cases where the predictor variables seem to work together; one predictor may influence “how well” another predictor works, something called an interaction effect or a synergy effect. We might then have to modify our formula to include interaction terms that look like

So our Linear Modelling workflow might look like this: we have not seen all stages yet, but that is for another course module or tutorial!

-

https://mlu-explain.github.io/linear-regression/

- The Boston Housing Dataset, corrected version. StatLib @ CMU, lib.stat.cmu.edu/datasets/boston_corrected.txt

-

https://feliperego.github.io/blog/2015/10/23/Interpreting-Model-Output-In-R

- Andrew Gelman, Jennifer Hill, Aki Vehtari. Regression and Other Stories, Cambridge University Press, 2023.Available Online

- Michael Crawley.(2013). The R Book,second edition. Chapter 11.

- Gareth James, Daniela Witten, Trevor Hastie, Robert Tibshirani, Introduction to Statistical Learning, Springer, 2021. Chapter 3. https://www.statlearning.com/

- David C Howell, Permutation Tests for Factorial ANOVA Designs

- Marti Anderson, Permutation tests for univariate or multivariate analysis of variance and regression

-

http://r-statistics.co/Assumptions-of-Linear-Regression.html

- Judd, Charles M., Gary H. McClelland, and Carey S. Ryan. 2017. “Introduction to Data Analysis.” In, 1–9. Routledge. https://doi.org/10.4324/9781315744131-1. Also see http://www.dataanalysisbook.com/index.html

- Patil, I. (2021). Visualizations with statistical details: The ‘ggstatsplot’ approach. Journal of Open Source Software, 6(61), 3167,https://doi:10.21105/joss.03167

| Package | Version | Citation |

|---|---|---|

| broom | 1.0.8 | Robinson, Hayes, and Couch (2025) |

| corrgram | 1.14 | Wright (2021) |

| corrplot | 0.95 | Wei and Simko (2024) |

| geomtextpath | 0.1.5 | Cameron and van den Brand (2025) |

| GGally | 2.2.1 | Schloerke et al. (2024) |

| ggstatsplot | 0.13.1 | Patil (2021) |

| ISLR | 1.4 | James et al. (2021) |

| janitor | 2.2.1 | Firke (2024) |

| lindia | 0.10 | Lee and Ventura (2023) |

| reghelper | 1.1.2 | Hughes and Beiner (2023) |

| supernova | 3.0.0 | Blake et al. (2024) |

Footnotes

The model is linear in the parameters

Michael Crawley, The R Book, Third Edition 2023. Chapter 9. Statistical Modelling↩︎

https://indrajeetpatil.github.io/ggstatsplot/reference/ggcoefstats.html↩︎

Gareth James, Daniela Witten, Trevor Hastie, Robert Tibshirani, Introduction to Statistical Learning, Springer, 2021. Chapter 3. Linear Regression. Available Online↩︎

Michael Crawley, The R Book, Third Edition 2023. Chapter 9. Statistical Modelling↩︎

Citation

@online{v.2023,

author = {V., Arvind},

title = {Modelling with {Linear} {Regression}},

date = {2023-04-13},

url = {https://av-quarto.netlify.app/content/courses/Analytics/Modelling/Modules/LinReg/},

langid = {en},

abstract = {Predicting Quantitative Target Variables}

}